Views from Finovate Fall: InterGen Data

It is not an exaggeration to say that such services will transform the very nature of financial advice, life insurance will become far more about enabling preventative behaviour and making provision for incapacity at certain points in life. Equally it will be possible to plan retirement income needs with a greater certainty based on a clearer understanding of personalised mortality.

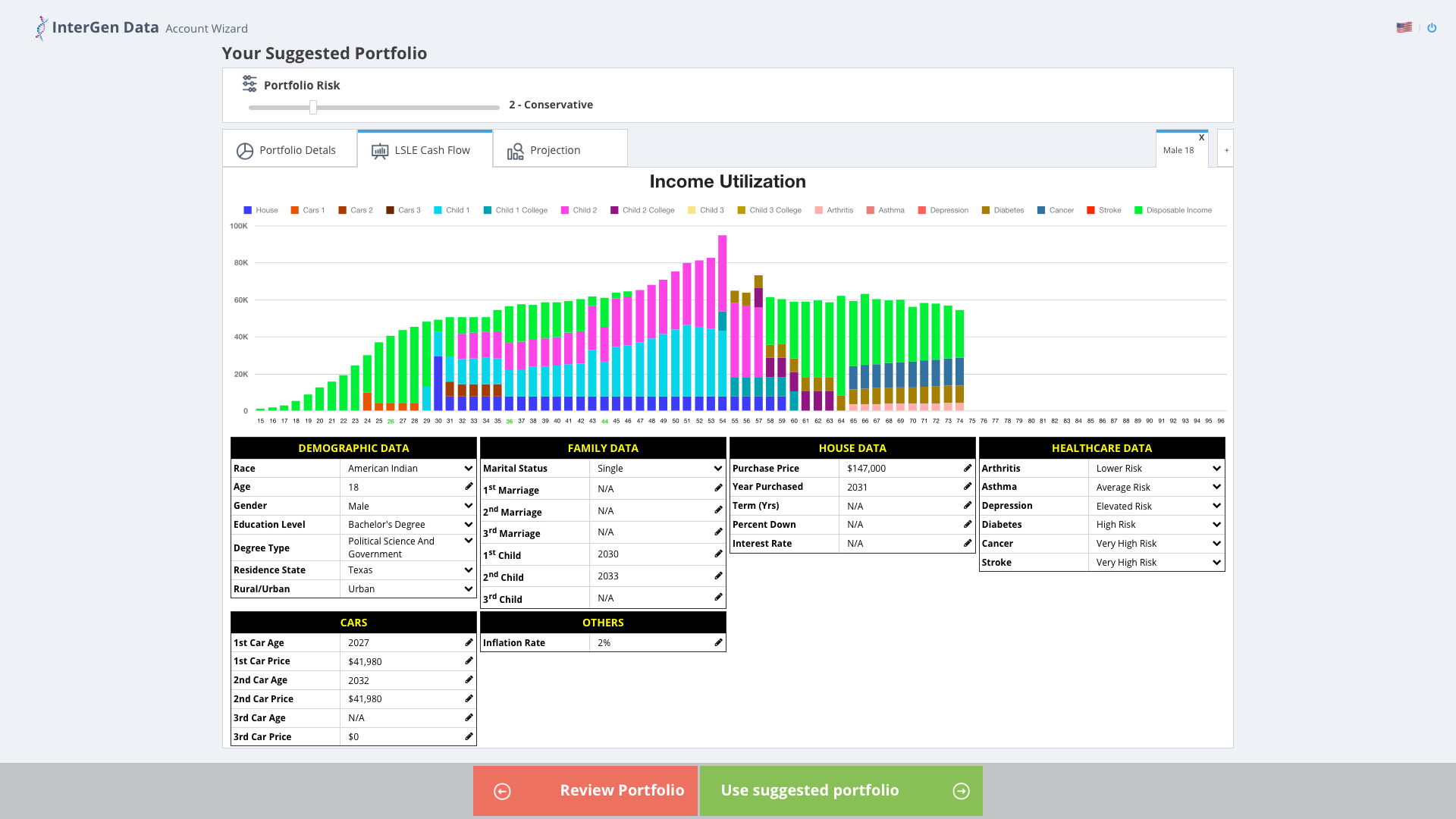

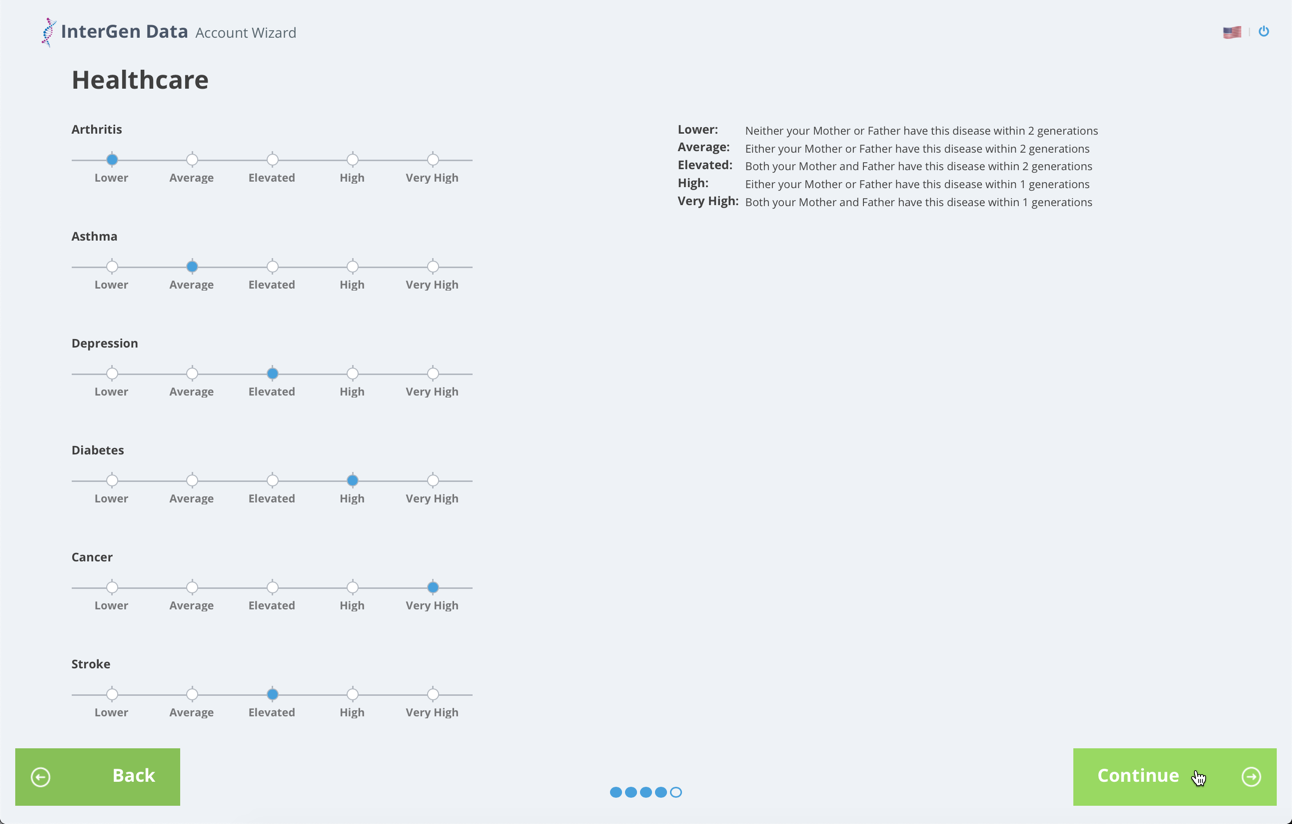

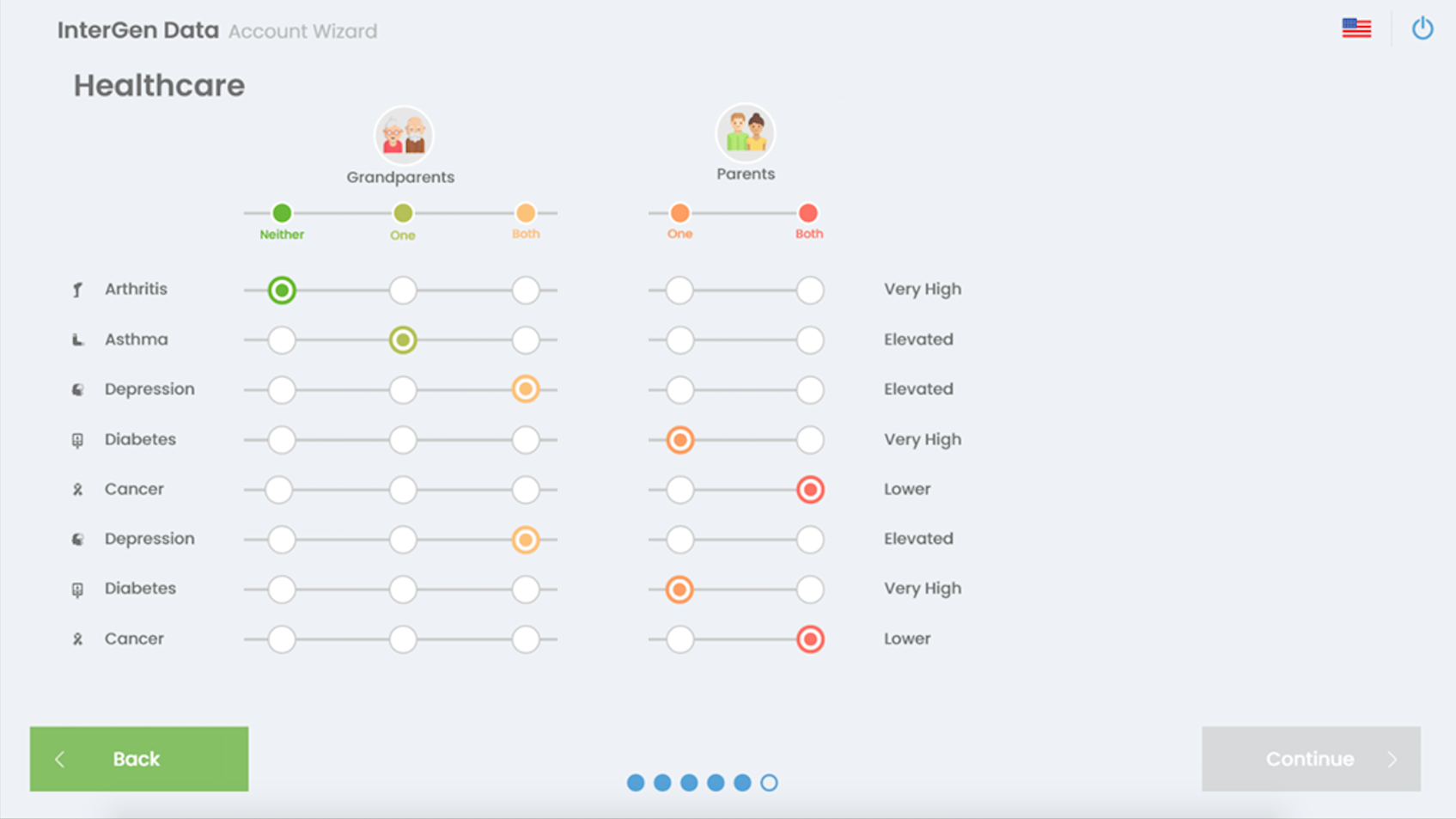

What differentiates Intergen from any other financial planning system I’ve ever seen is the way in which it assimilates detailed information on family history and then uses analytics to predict future life events. As part of the process the user populates family medical history from both parents and grandparents to build a likely future health profile.

Kirk included some very personal examples to illustrate this including his grandfather’s Alzheimer’s and the huge financial burden which it put on the family, including providing a long term care facility costing $15,000 a month for four years at a total cost of close to $700,000.

This presentation was the first time I had every heard best interest and suitability raised in a Finovate presentation. If I have one criticism of the Finovate shows it is that too many presenters focus on selling more products, frequently with little or no interest in if they are actually the right solution for the customer. If the conference is going to move more towards services that produce the right consumer outcome that will be a very good thing.

The data is designed to grab the client’s attention and facilitate much deeper conversations. I have previously seen a version of the system working over Amazon Alexa where it is far more sophisticated than the typical Amazon skill and gives some real insight into the art of the possible in the future for financial advice.

Combining data driven predictions of future life events with traditional cash flow has enormous potential to enhance the science and accuracy of financial planning and consequently the suitability of the advice given.

I first met Robert Kirk at the Technology Tools for Today Enterprise conference last October and have spoken to him at length about his system and the methodology. Intergen Data is the first time I’ve seen some of the scenarios I have expected for some years based on big data, advanced medical data and artificial intelligence put into practice. I’m convinced the potential of his system to transform financial advice is enormous.

A demo of the InterGen Data system can be viewed at below: