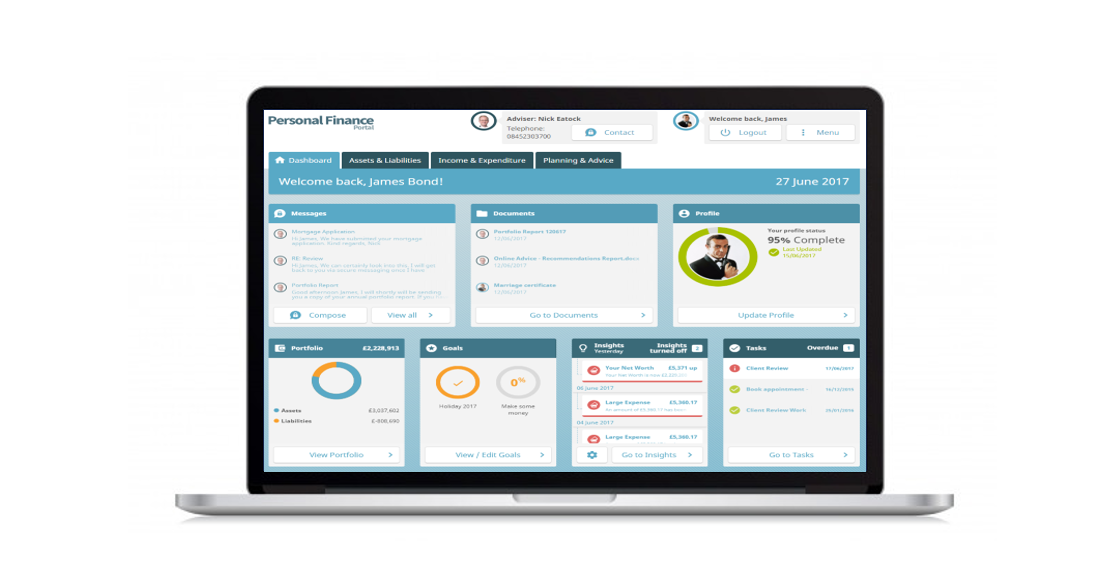

Intelliflo Personal Finance Portal: Empowering clients with around the clock access to their finances

There has been a big shift in consumer attitudes and a desire for all things digital. Intelliflo were one of the first within financial services to see this trend towards online digital engagement and created the Personal Finance Portal (PFP), which is an online digital personal financial management hub. The tool has been designed to help existing and new adviser clients to provide an enhanced digital service.

From the client’s point of view, it provides a single aggregated view of their pensions, investments, protection and property assets. Via Yodlee’s aggregation capability, PFP’s premium service enables users to access real-time data from their personal banking, credit card and savings accounts. The end user is in control of how much of this is shared with their adviser.

From a business point of view, PFP provides adviser firms with a tool to increase its clients’ understanding of and engagement with their financial affairs. The tool can also reduce adviser firms’ operating costs by streamlining processes such as fact finding and ongoing servicing. The adviser is at the forefront of the customer’s mind each time they engage with their personal finances and the tool can be branded via the white labelling services which reinforces the firms branding. The adviser will be seen as providing useful tools to help the customer, which should place them in a stronger position for long-term client retention.

Additionally, the tool allows clients to pre-fill fact finds, communicate via secure messaging, share tasks and digitally support the conventional advice process. It also incorporates an automated advice capability which advisers are using for the less actively advised clients.

Robert says:

“PFP’s tools add another dimension to advisers looking to increase the scope of their offering. The tool provides a more interactive and appealing financial planning journey.”

Our Thoughts

GOOD FEATURES

- Secure messaging, video chat and document signing.

- Savings goals linked to a specific current account or investment balance.

- Real-time portfolio valuations.

- Link with Intelligent Office (IO), provides users with their personal data.

GREAT FEATURES

- Provides a single aggregated view of their pensions, investments, protection and property assets.

- Ability to increase adviser-customer communication and brand awareness (through white labelling).

- Cost effective in automating existing time-consuming tasks such as fact finding.

Improvements

-

Add educational content to help clients get a better understanding of the analysis which the portal provides.

-

Identification of a ‘safe to spend’ balance.

-

Introduce smart spending and savings initiatives.