My experiences using Intelliflo – Intelligent Office

As a practice management system, the Intelligent Office (iO) system provides a range of functionality focused on back office, pre and post sales advice and ongoing servicing of clients. The system aims to automate the processes an adviser firm would go through day-to-day to help increase efficiencies. To list a few, advisers can configure workflows, produce fact finds and view real-time valuations.

Having recently worked at a firm where the practice management system was iO, the functionality that I was most impressed by were the tasks and workflow tools, the Personal Finance Portal (PFP) and the various integrations Intelliflo has with third party providers.

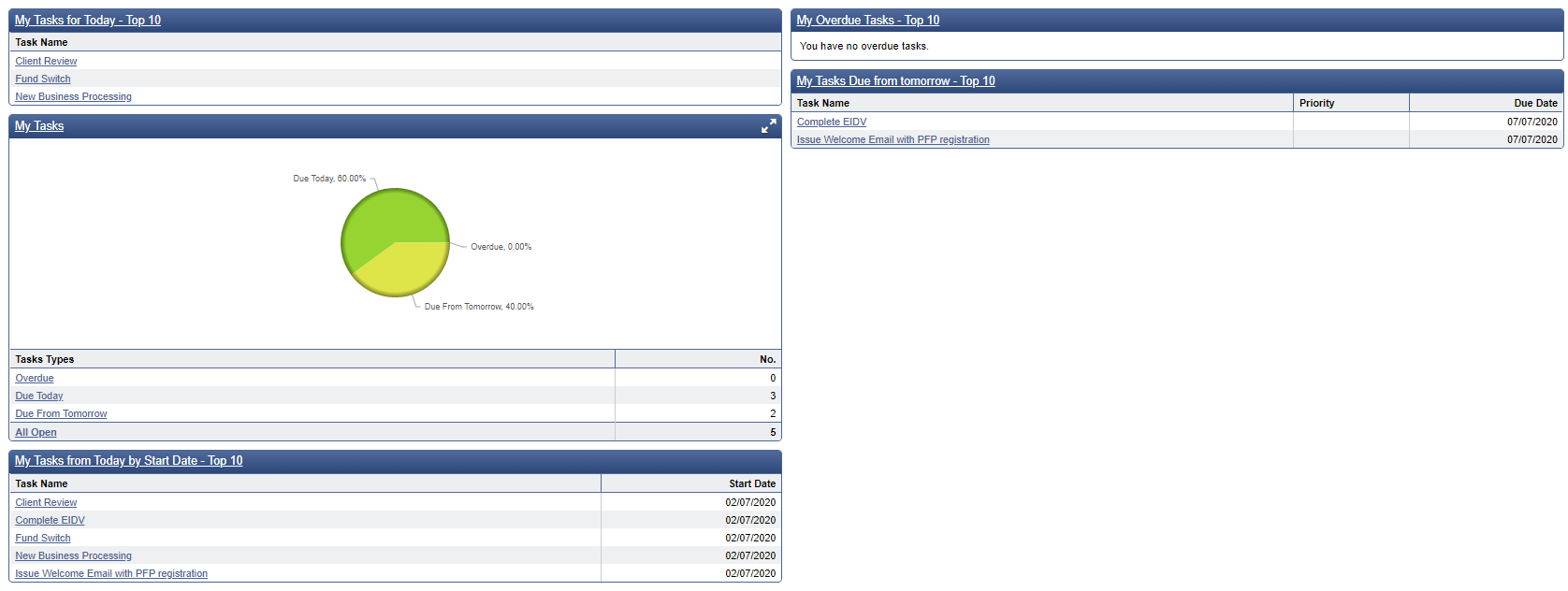

Any adviser administrator or paraplanner will know managing workloads can be a full-time job if you are not careful. Communication is key to managing activity effectively. Being able to set up tasks and/or workflows in iO, which can then be assigned to individual clients, as well as individual members in the team, really helped me manage my activity. Personally, I liked that all the tasks assigned to you were viewable via the main dashboard. This provides a summary of any overdue, outstanding and future tasks that need to be actioned. A function I believe comes into its own when working with several advisers and multiple clients.

iO offers users access to various platforms, product providers, quote portals and wealth management tools via integrations. Valuation and data links provide users with information on their client’s holdings and investments. This helps administrators, paraplanners and advisers at various stages of the client lifecycle. Being able to see a client’s holdings and get up to date valuations, sometimes in real time, depending on provider, without the need to contact multiple parties can save huge amounts of time and allows you to focus more on servicing clients.

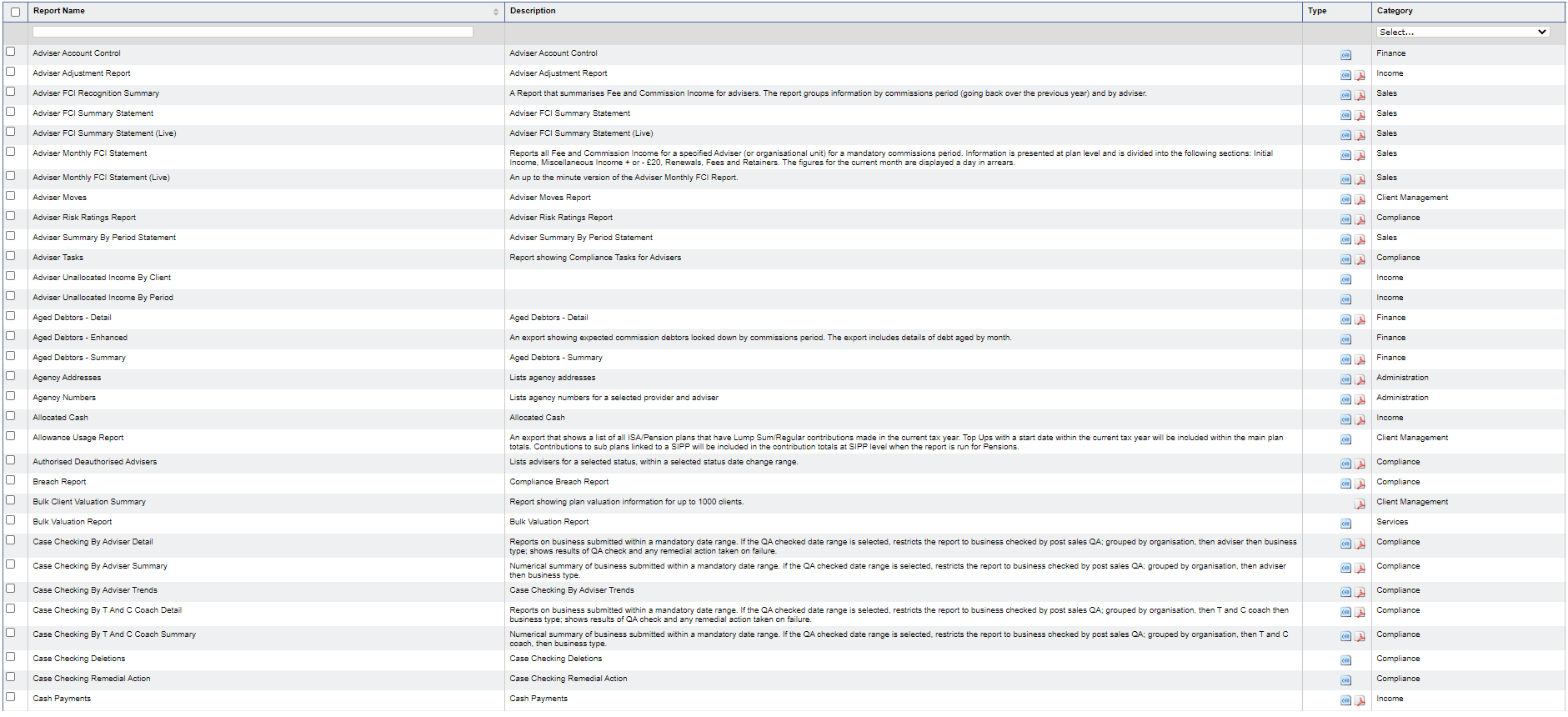

Understanding trends, interpreting data and having oversight of your business is exceptionally useful. Within iO you have access to over 125 pre-loaded Management Information (MI) reports (for example: administration, client management and income) as well as being able to configure and create your own custom reports. These can be produced in either PDF or CSV file formats for easy viewing and further analysis. Although a very good feature, where I do think these MI reports could be made more visually appealing is with the addition of coloured graphs and charts to help interpret the data better.

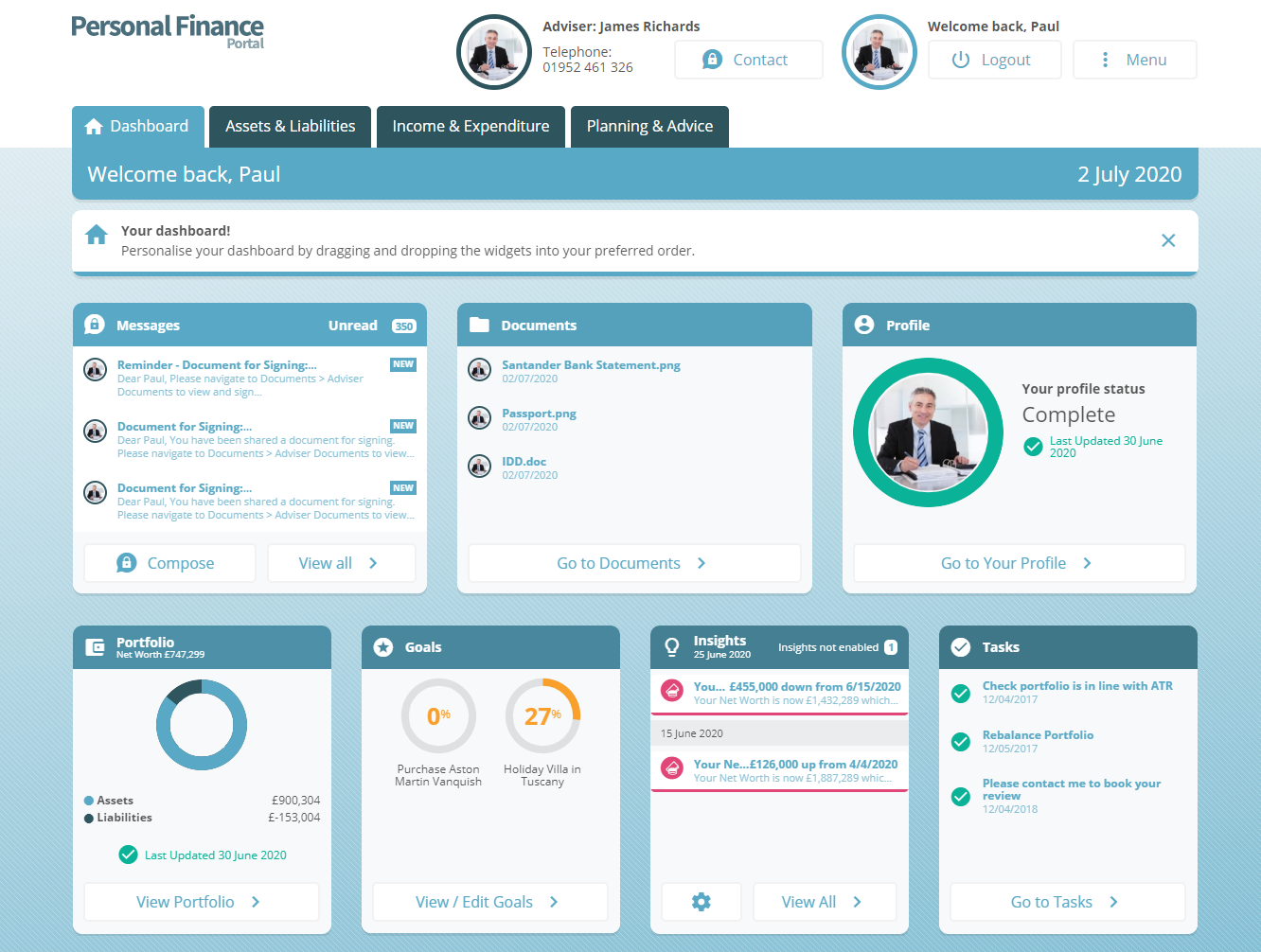

Businesses of all sizes are increasingly being subject to hacks and data breaches. The fines and compensation for these violations keep getting bigger and bigger. Given the highly sensitive data financial adviser firms hold it is crucial to treat this data with the upmost care and security. To help with this iO has the capability through its online client portal, the Personal Finance Portal (PFP), for advisers to interact with their clients in a secure and efficient way. PFP provides users with secure online storage for important documentation, the ability to send secure communications and the option to view fund and portfolio details. PFP also gives your clients the ability to review, edit and sign documents, view valuations, asset details and any documentation their adviser firm wishes to share with them, without the need to send out hard copies in the post. Not only do these features help increase time and cost efficiency, something adviser firms are continually looking to improve, but they also improve an organisation’s data security.

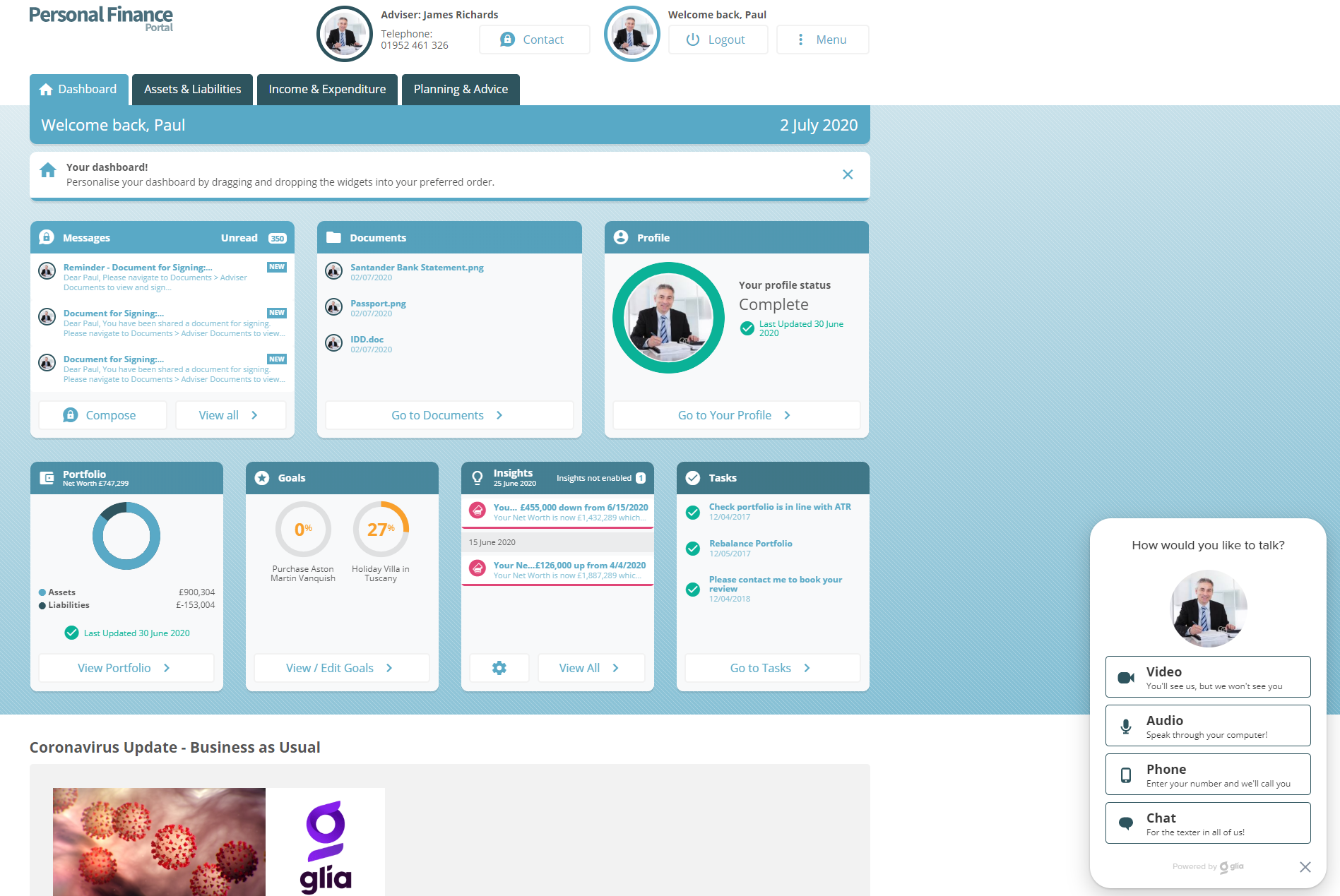

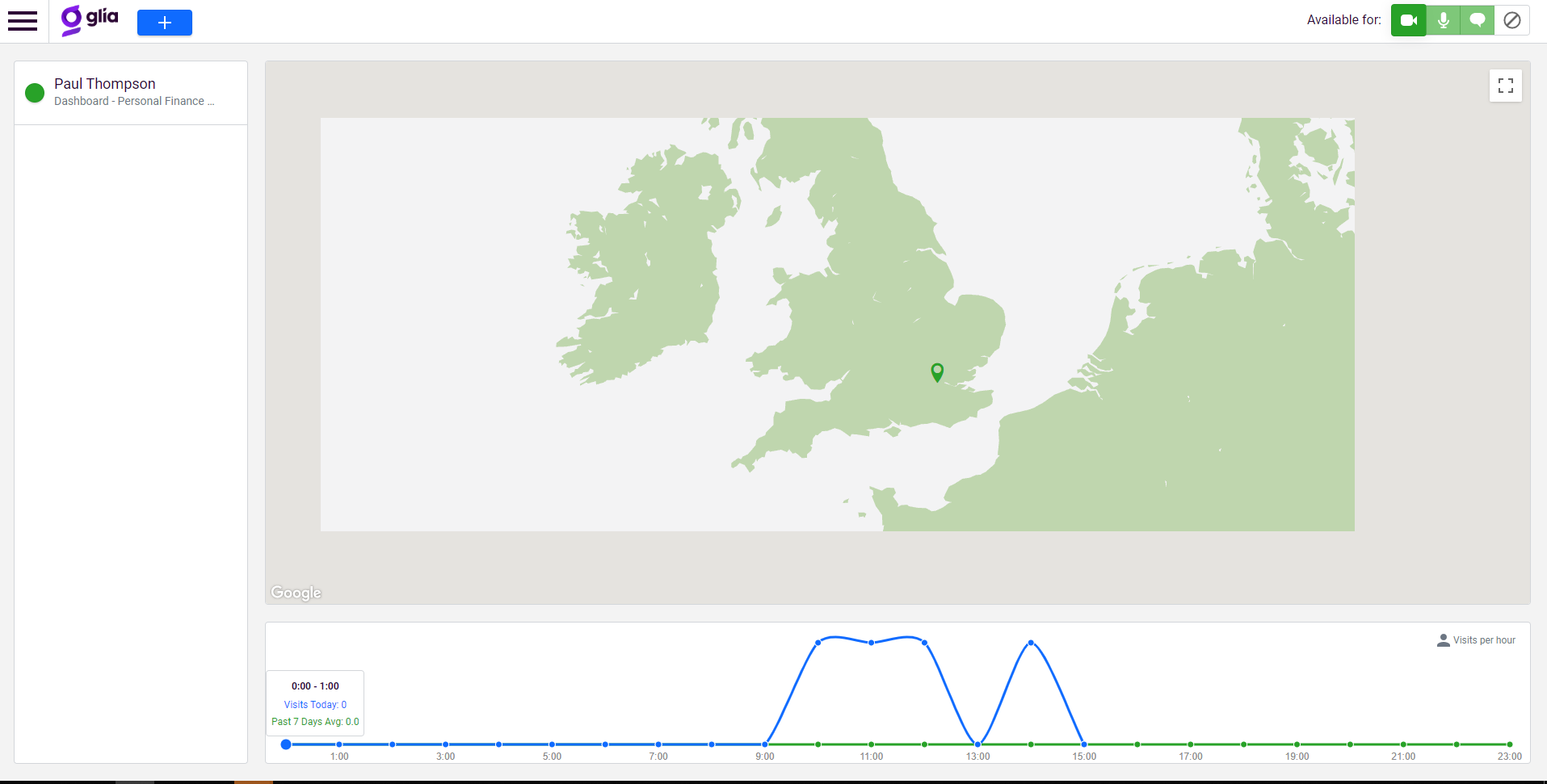

Additionally, users can take advantage of Glia (formerly SaleMove) technology, which is fully integrated within PFP. Although I did not personally use this feature, Glia enables advisers to conduct virtual meetings either by text chat, audio or full video conference. Glia ensures that the text and audio of all meetings are fully recorded, including any files shared, and then saved against the client record on iO. Not only does this have huge benefits from a compliance perspective, but as an administrator, paraplanner or even adviser having the ability to listen to meetings after they have taken place has so many advantages as well. As an administrator and paraplanner, the hardest part of your job is having to decipher and interpret handwritten meeting notes. Consequently, having the ability to listen to the meeting recording and review any documents shared can help you understand both the client’s and adviser’s opinions much better than any handwritten meeting note could ever do.

Although a lot of these features and tools have become extremely useful in recent months with firms being forced to adopt a work from home arrangement brought about by the recent COVID-19 outbreak, I believe that going forward adviser firms should continue to adopt and learn how to utilise them to their fullest capabilities. Not only will this help those using the software to continue to save time throughout the client servicing process but also help them reduce their overall servicing costs.

Adam Says

“iO is a practice management system that offers advisers a range of functionality, that can help increase productivity, reduce servicing costs and create a better dialogue with clients. As a business management system, it has many capabilities but with the iO Store, which allows you to purchase and install apps, users can customise and expand this functionality even further.”

Our Thoughts

Good Features:

- Multiple integrations.

- Virtual meeting software via Glia.

Great Features:

- Secure messaging facility through PFP.

- Digital signature functionality with integrated DocuSign.

Improvements:

- Although Glia will record chat transcripts and audio calls, it unfortunately does not have the capacity or option to record and save video meetings and/or any screenshares between firm and client.

- Having the ability to create MI reports is a welcomed feature however, the reports that are produced are not as visually appealing as others on the market.