How many software systems does it take to service your clients?

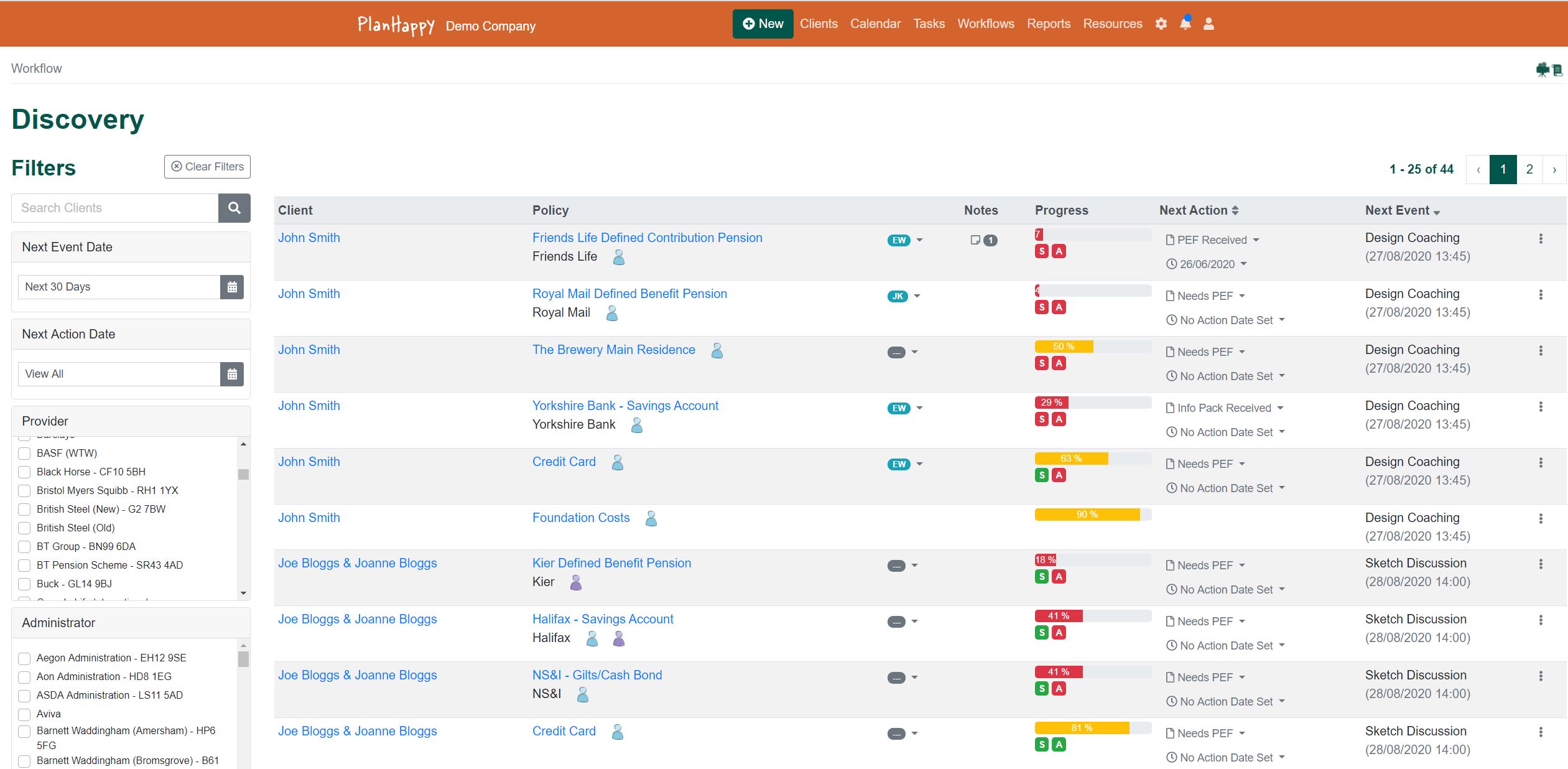

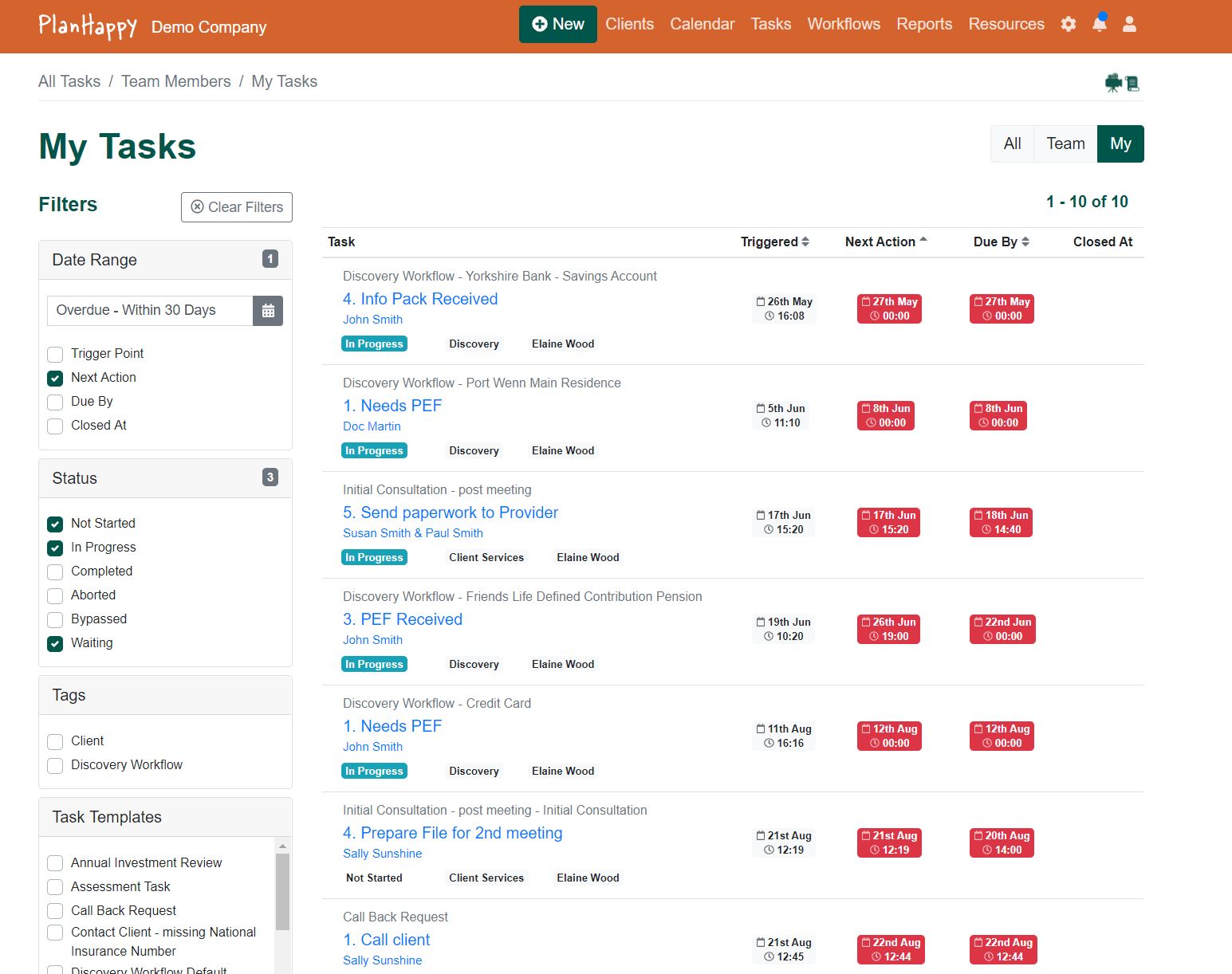

PlanHappy software is an “End to End” fully customisable Financial Advice software solution that aims to provide everything a financial adviser would need to run their business in one integrated solution. The system contains various modules, including: Practice Management, Business Workflow & Process Automation, Advice & Planning Tools, Investment Solutions, New Business, Fees & Revenue Management and Training & Competency. These can all be accessed through any web browser and can also be downloaded from the iOS and Android stores.

Within the Advice & Planning Tools module users can generate questionnaires, such as Attitude to Investment Risk, Attitude to Transfer Risk (for defined benefit schemes) and Coaching Scans (for lifestyle financial planning sessions) all of which can be completed by clients electronically. Not only does this help to reduce posting expenses but also increases efficiencies, with the need for clients to manually complete and return questionnaires removed. On top of this, firms can integrate centralised investment propositions and automatically map clients risk scores to asset allocations.

- Being able to link external calendars to the PlanHappy system.

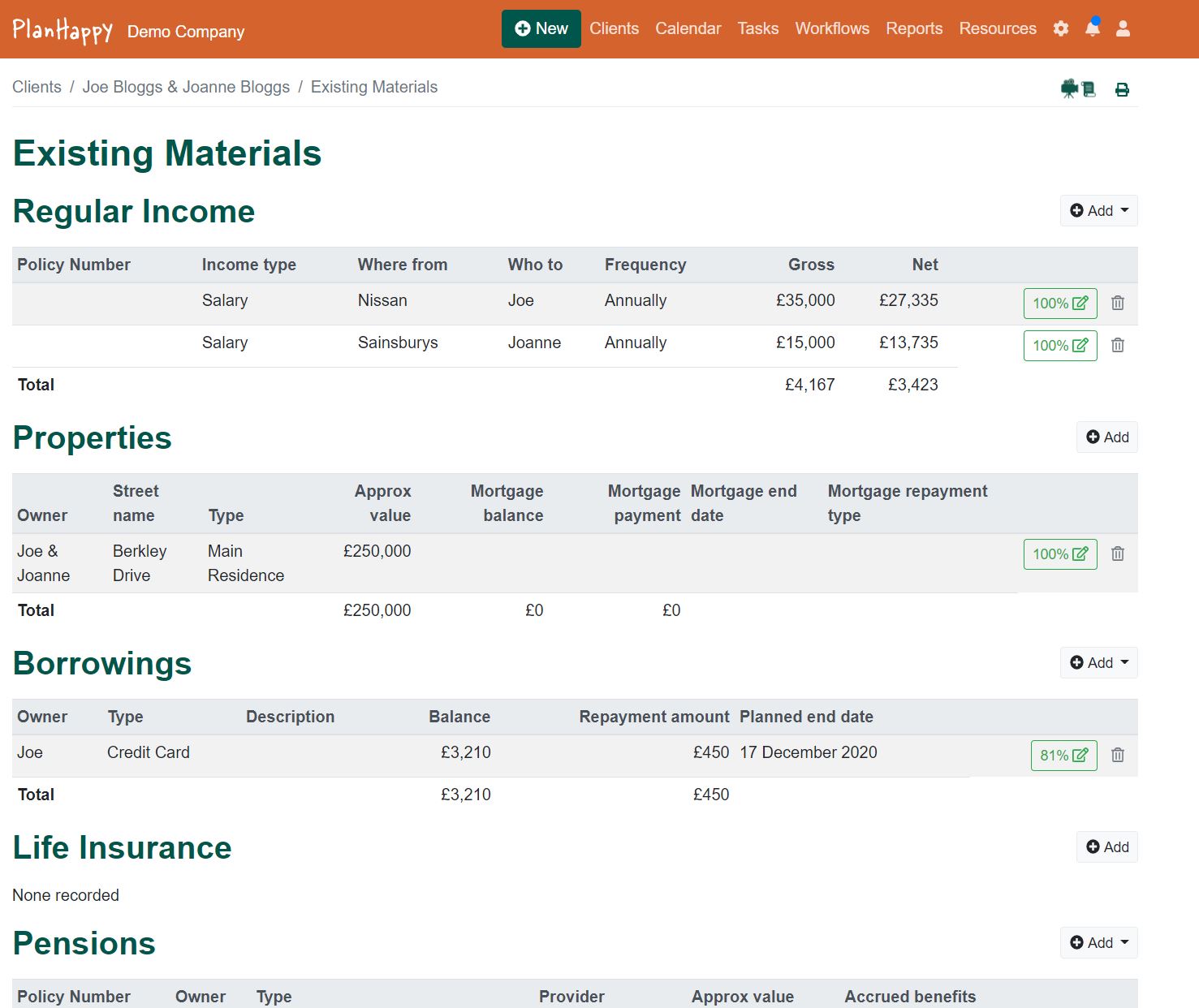

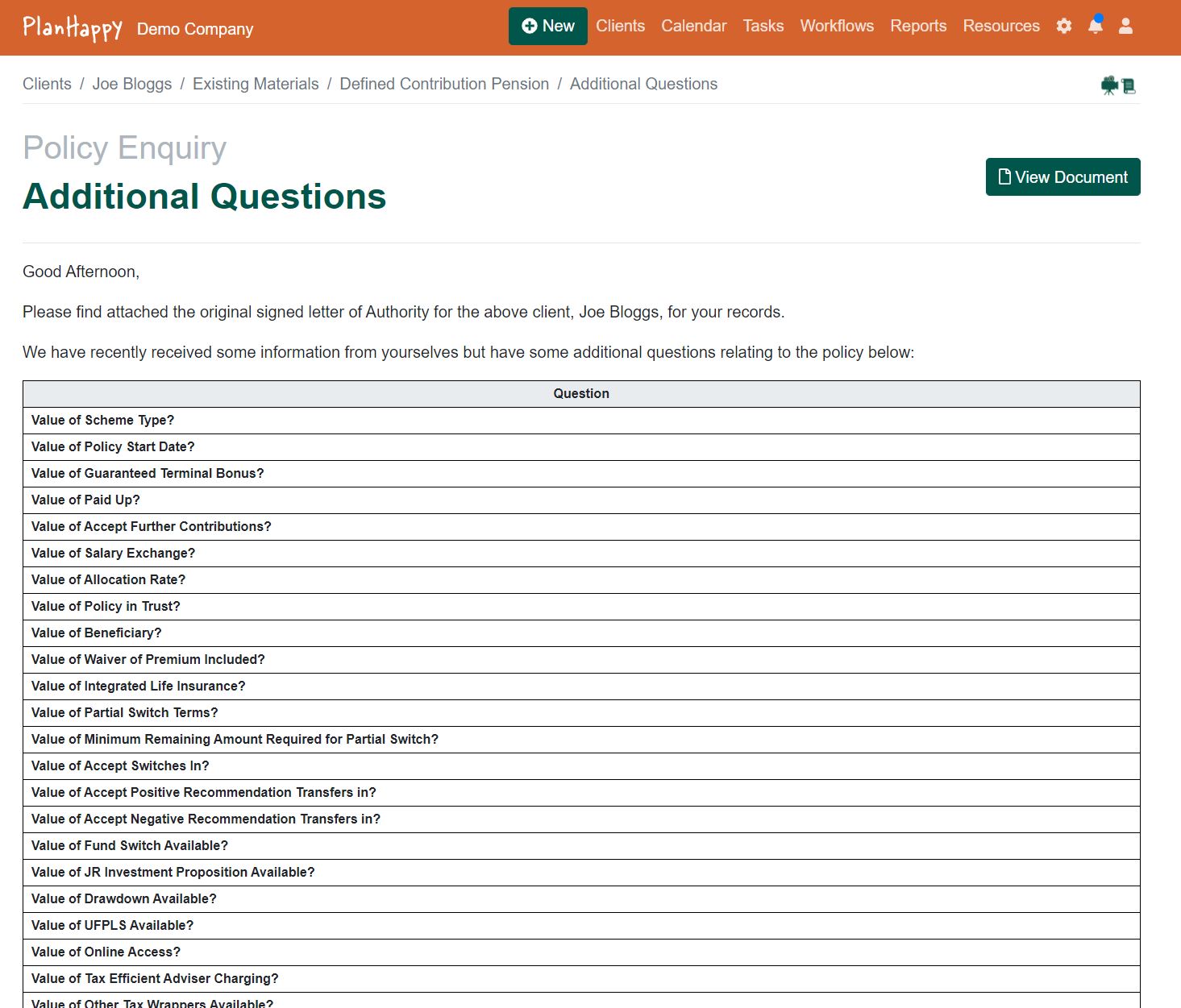

- Being able to set-up automated letters of authority and gap fill requests can be extremely helpful when sending multiple requests to varying providers.

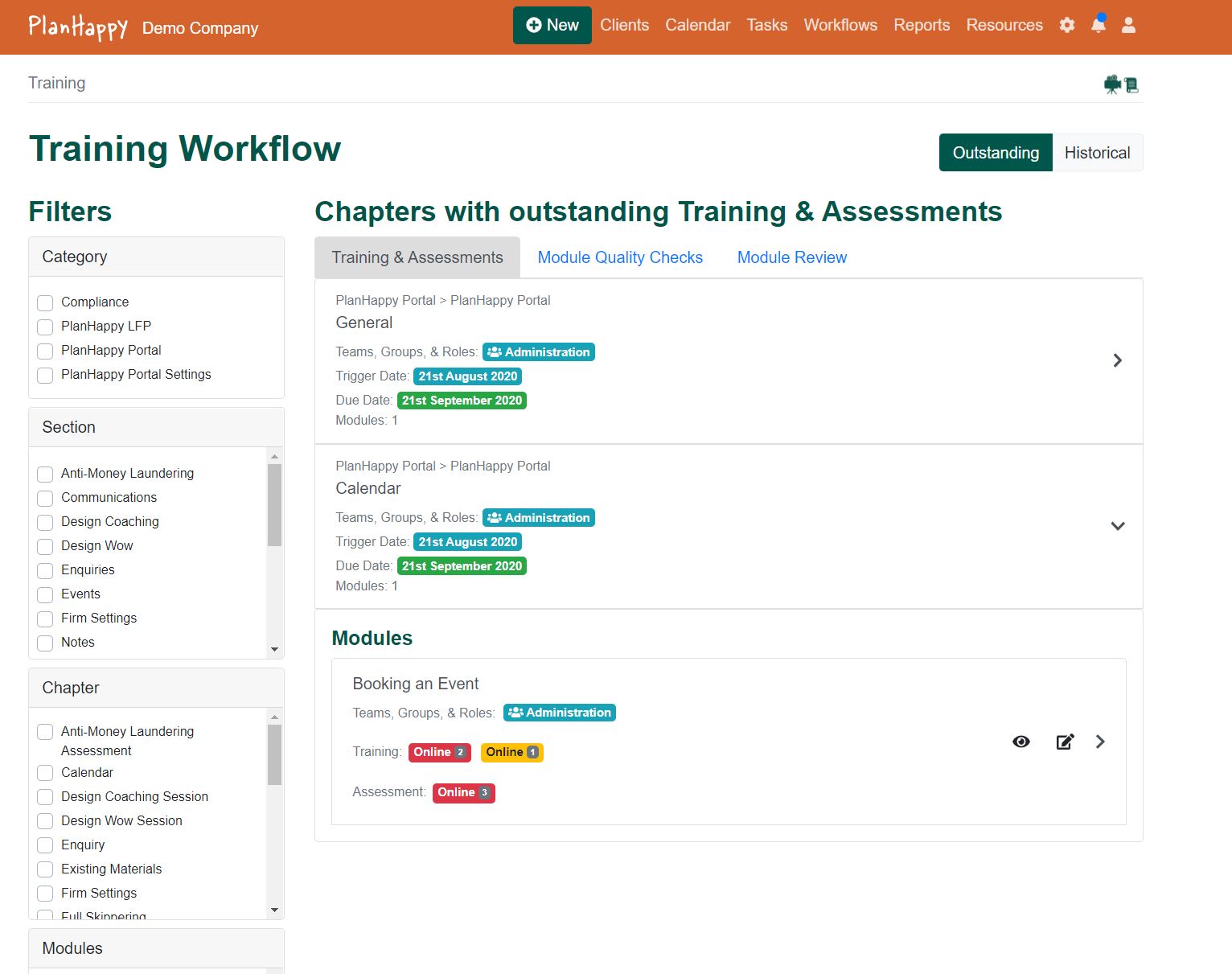

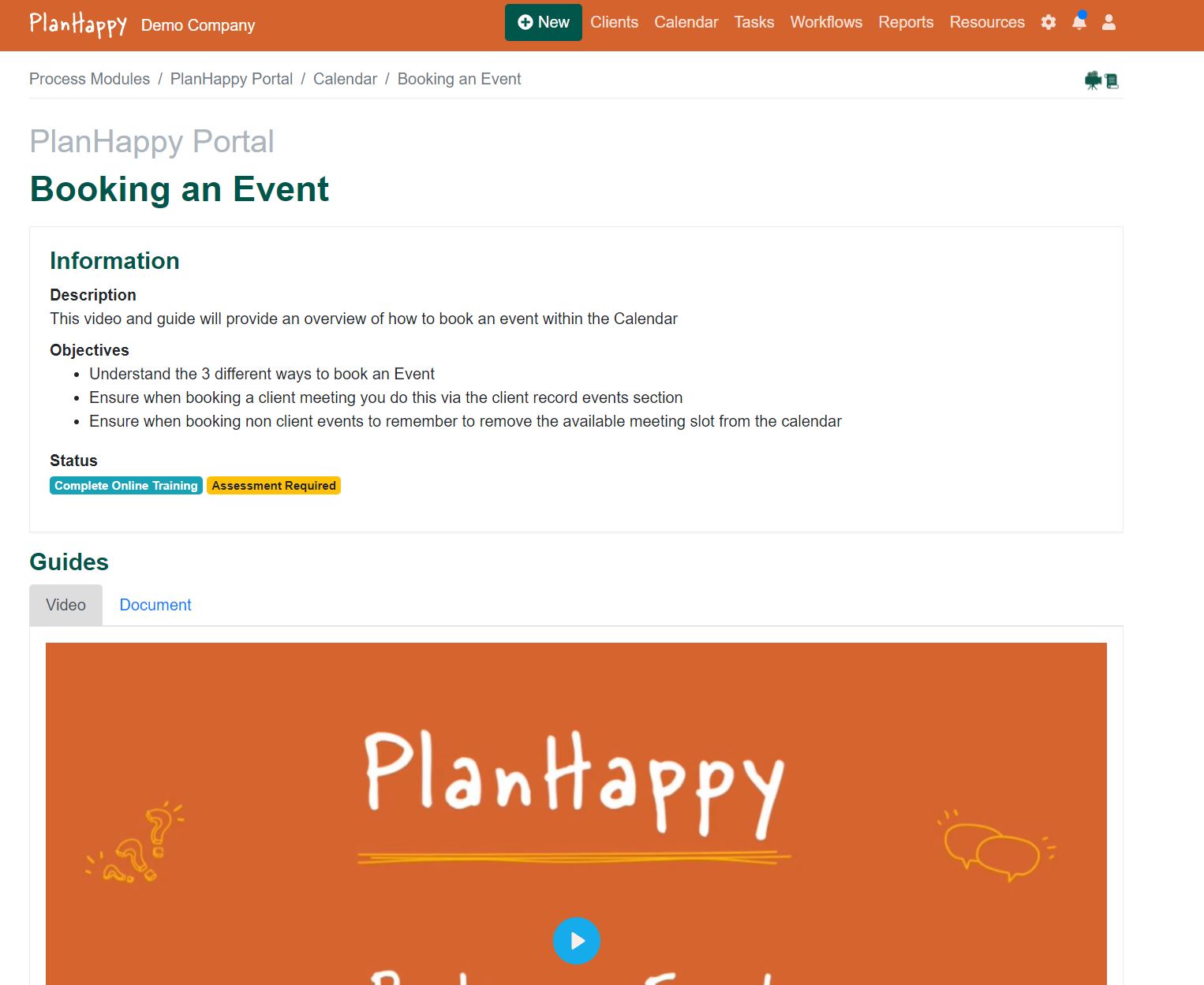

- The Training & Competency module

- It would be great to see virtual meeting and screen sharing software included.

- The addition of cashflow modelling software as part of the overall suite so that information added to the practice management system could be fed directly into the modeller.

- Users are currently unable to produce Management Information (MI) reports. Again, this would be a very useful addition.