My Experiences using FE fundinfo – FE Analytics

Some people might think FE Analytics is a tool that only investment specialists would use however, my experience confirms this is not the case. When used properly, FE Analytics offers a variety of features an administrator, paraplanner and adviser will all find extremely useful.

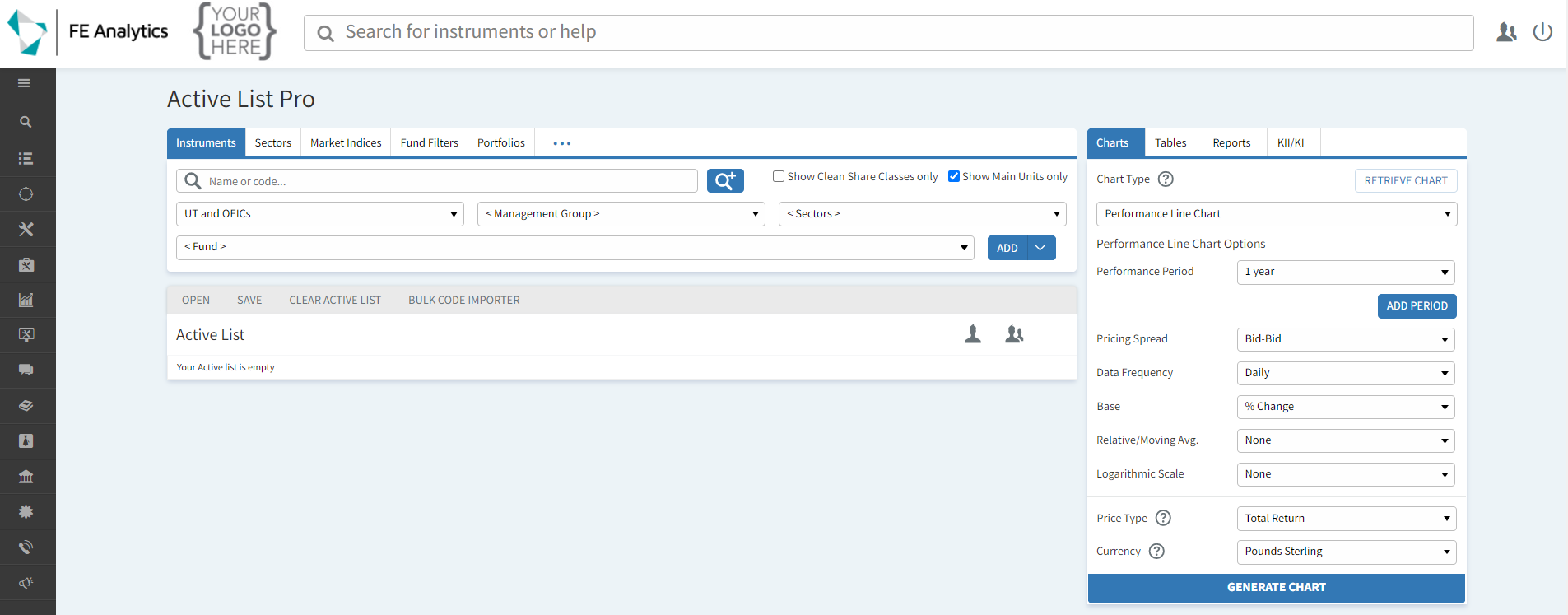

FE fundinfo describe FE Analytics as a one-stop shop for investment research and analysis, portfolio construction, due diligence and ongoing monitoring. It is designed to enable users to perform in-depth research and analysis on over 300,000 instruments. It can also create fully customisable charts, tables and reports including portfolio comparison, past performance, asset allocation and statistical measure reports (for example volatility, alpha, beta etc). In addition, the reports scheduler allows reports to be run automatically on a daily, weekly, monthly or ad-hoc basis. Not only can these features assist with ongoing research and monitoring but helps to formulate informed investment decisions and recommendations.

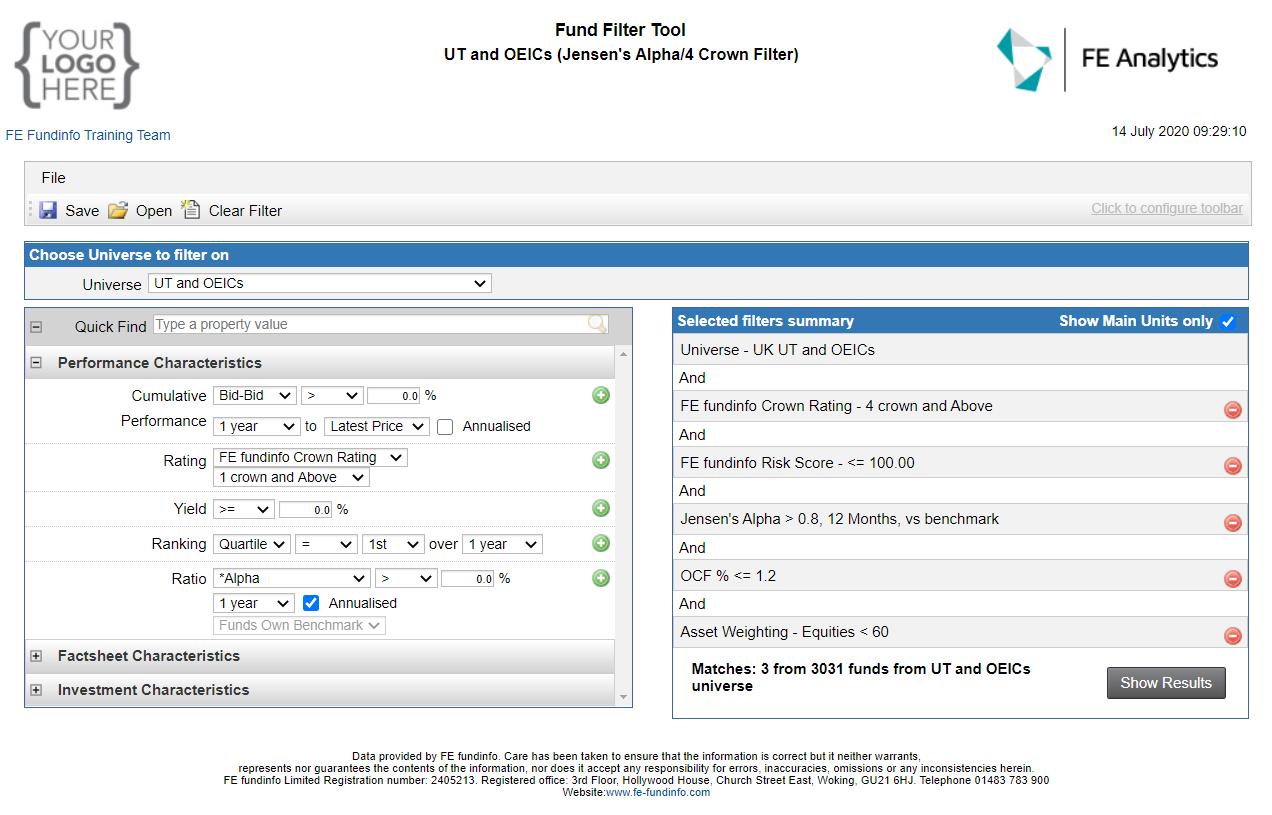

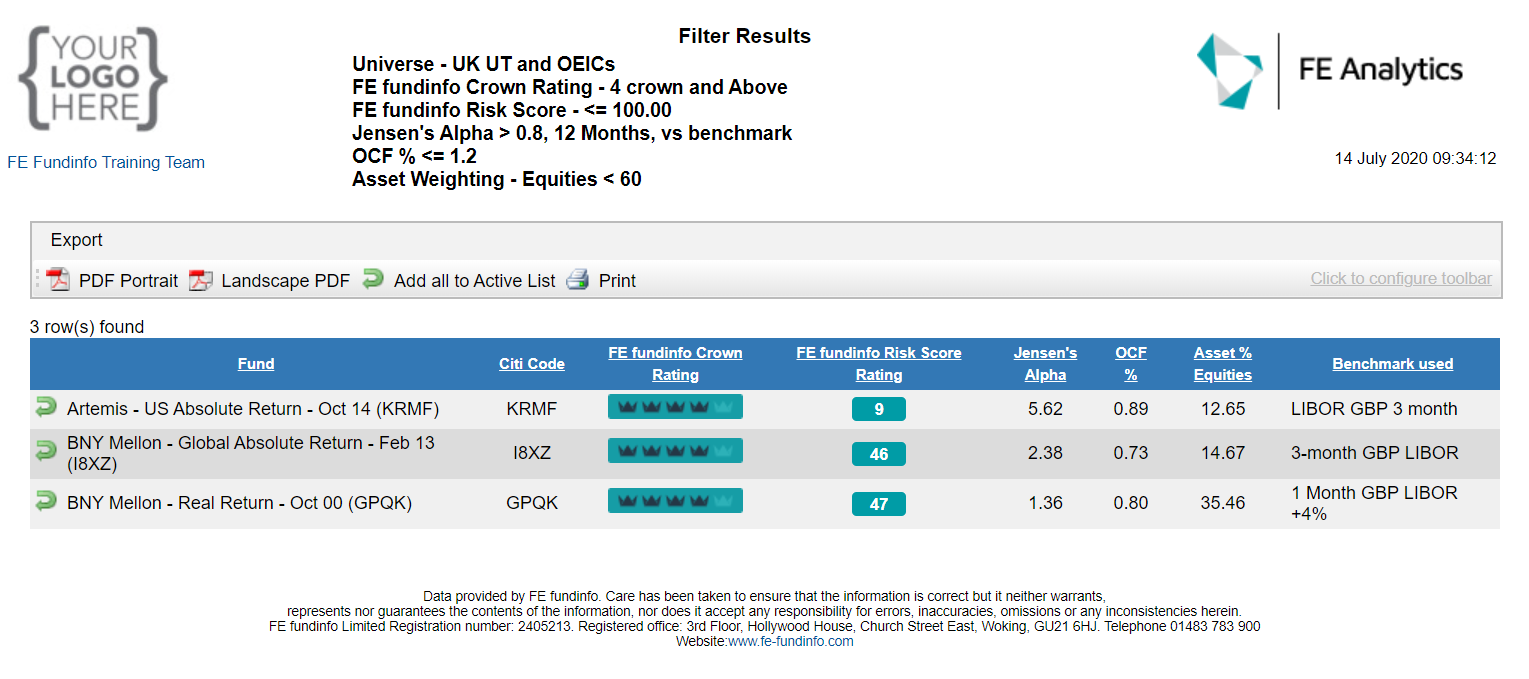

With a considerable amount of functionality on offer, I thought it would be best to focus on some of the features I used the most both as an administrator and paraplanner. I commonly used the fund-filter to narrow down funds and investments based on a variety of filters for example fund rating, performance, geographical location and sector (to name a few). As well as being able to perform further research and analysis on the filtered funds, users can extract a report, to PDF or MS Excel, showing the results and save this on the client file for compliance purposes. Personally, I like that you can save pre-set fund filters to help save time when reviewing and researching certain sectors. This also allows members of the team who are not necessarily involved in investment decisions to produce research reports appropriately and efficiently.

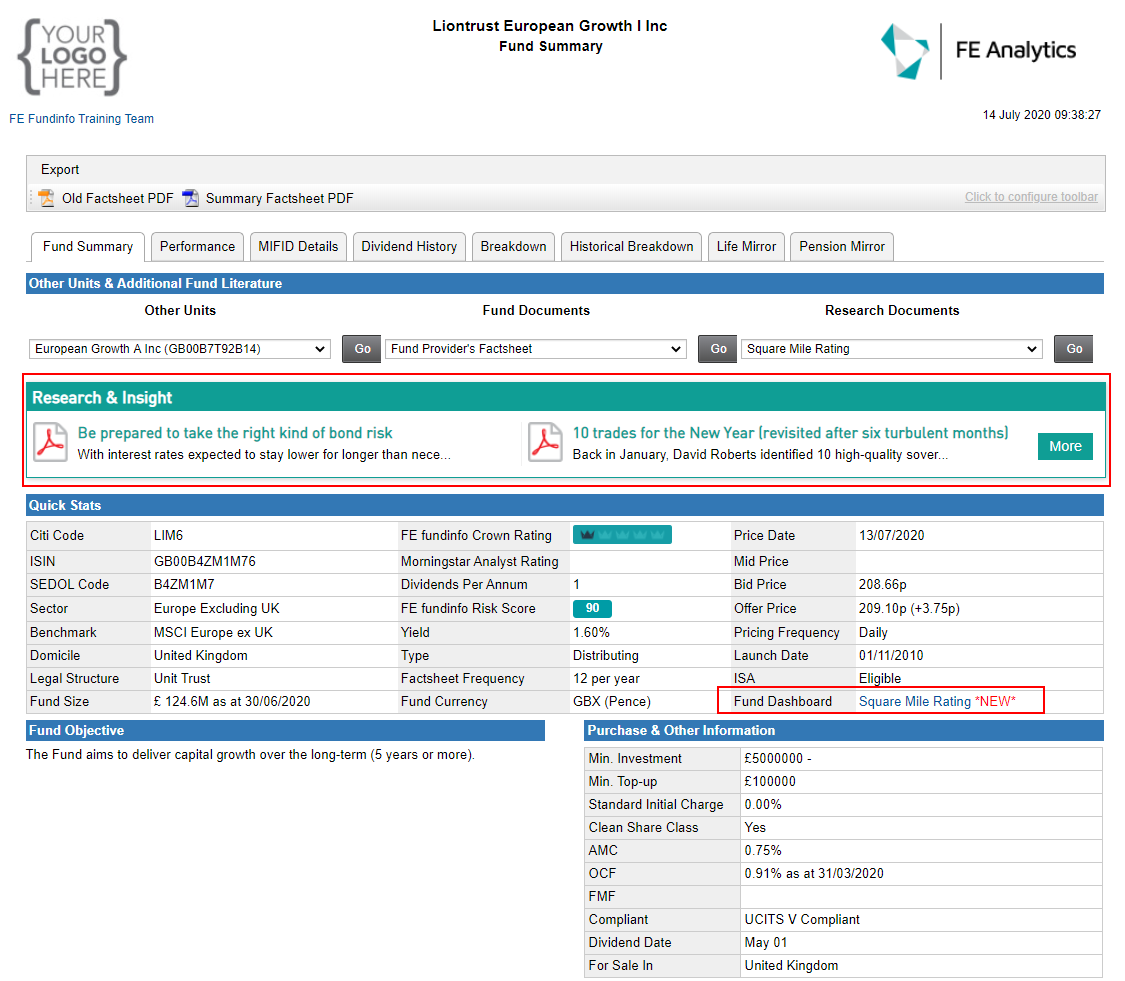

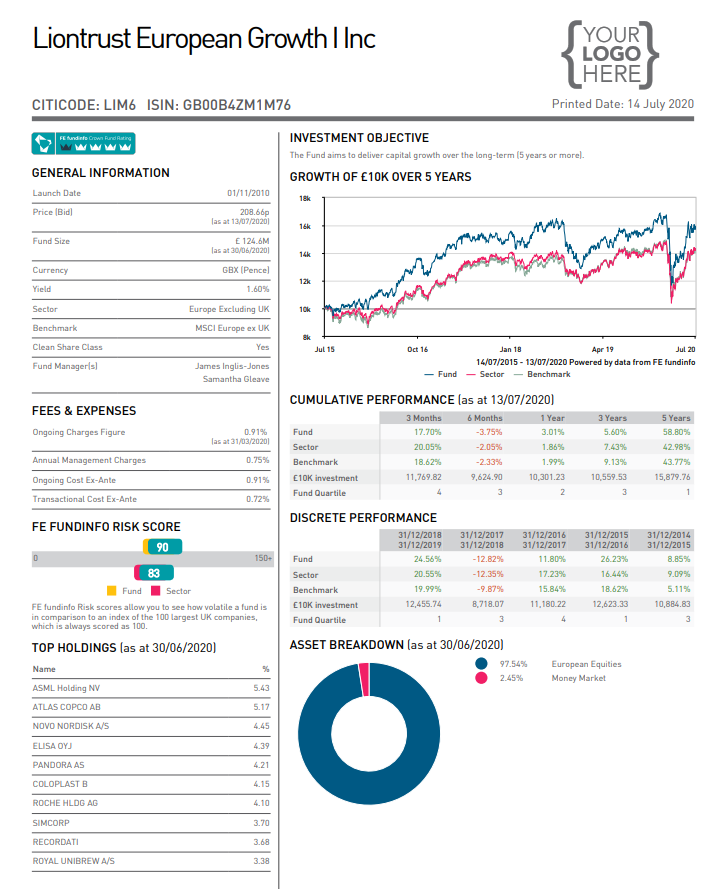

As well as having the ability to perform in-depth research and analysis adviser firms have access to fund documentation including factsheets, annual reports, prospectuses and KIIDs. Gone are the days of having to search multiple investment provider websites looking for up-to-date fund literature! FE fundinfo offer access to original fund provider literature as well as their own fund factsheets, which can be white labelled. I particularly liked that once a client’s portfolio had been set up and saved on FE Analytics you were able to print all the factsheets and KIIDs in one go, rather than one at a time. As an administrator this saved huge amounts of time when preparing meeting packs and/or printing supplementary documents to go with recommendation reports. From a paraplanners perspective, as the client’s portfolios has already been set up, performing ad-hoc research and analysis or examining a client’s portfolio prior to their annual review is significantly more efficient.

I regularly used the Bulk Code Importer which allows you to import large numbers of funds directly into your active list or portfolio in one go. The importer also ensures that any duplicate funds are automatically removed before being added. This helped to save huge amounts of time when onboarding new clients, consolidating their investments or starting fund research from scratch.

Ongoing monitoring of clients’ portfolios can be a tricky task especially when you are looking after multiple clients across various advisers. FE fundinfo supports its subscribers by being able to create alerts for certain events and changes (including decreases in fund values, tolerances falling below a certain level and ratings changes etc). This allows you to stay on top of fund and investment changes as they occur, allowing you to continue working as efficiently as possible, knowing that you will be alerted when changes arise, without the need to continuously keep checking. In addition, being able to calculate reduction in yield and ex-ante costs and charges prior to annual review meetings helps advisers demonstrate the reasons for performing fund switches as well as meet MiFID II and FCA requirements to disclose all costs and charges associated with the investment business. Calculating these can be a laborious process, if done manually, so having these calculators available is a fantastic addition.

However, can too much information be a bad thing? With so much information on offer users may find the tool overwhelming. At times it can be hard to pinpoint exactly what is needed quickly and efficiently. In my opinion a welcomed addition, to an already comprehensive tool, would be the ability to set-up customisable user profiles for specific job roles, helping to filter out any unnecessary information and locate the areas your particular job function utilises the most. To help, FE fundinfo offer ongoing training and support to all their users via telephone, email, live chat and access to their online training academy. I personally liked the live chat feature, which was extremely useful when I was struggling to locate something or had a quick query whilst using the tool.

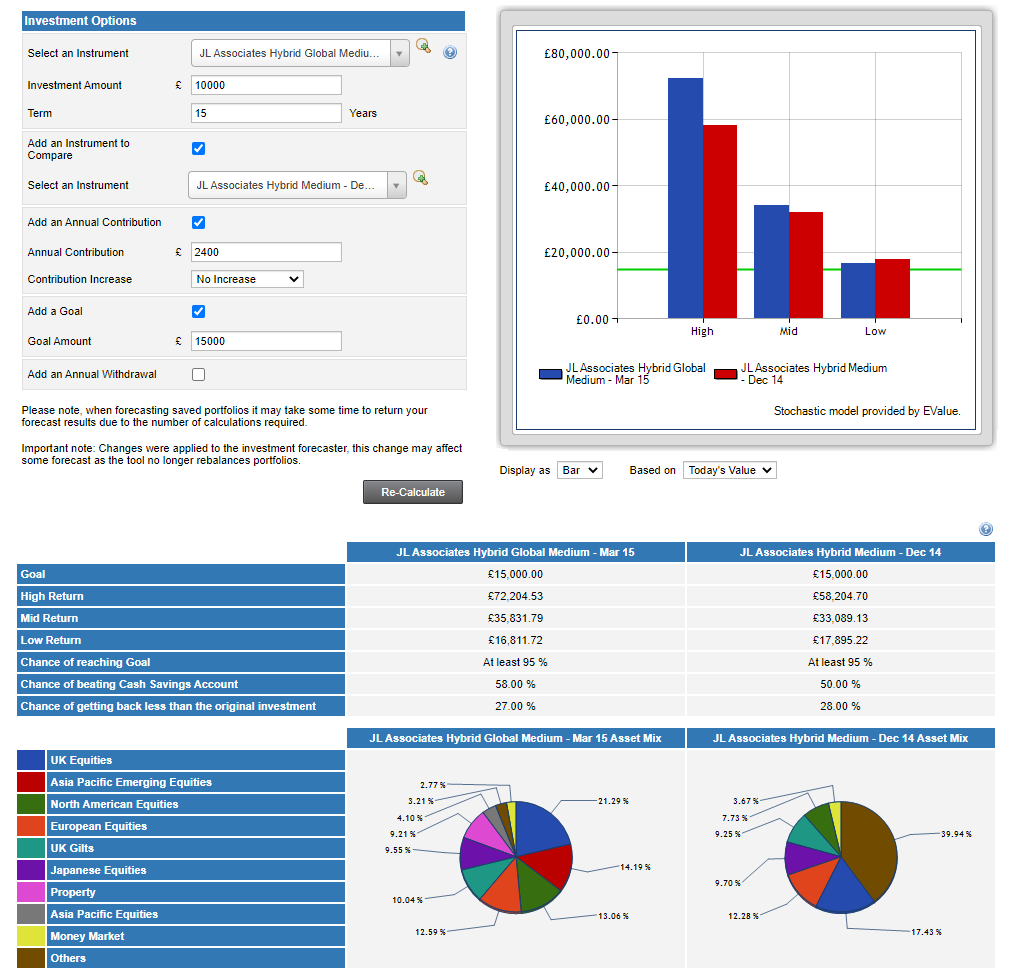

There were of course features that I did not actively use on day-to-day basis but feel are very useful to have. One of these was the Investment Forecaster. This helps advisers demonstrate to their clients how achievable their investment goals are. As well as being able to select an instrument, advisers can set initial investment amounts and term, include an annual contribution or withdrawal and set a goal the client wishes to achieve. This information can then be rendered in a client friendly report that offers a better understanding of whether targets are achievable and/or whether adjustments need to be made. This report offers insights such as percentage chance of achieving goal, percentage chance of getting back less than the original investment and percentage chance of beating cash. All of these are compelling when discussing a client’s attitude to risk, capacity for loss and their future aspirations.

The other was the Client Manager tool. Users can set up individual client folders and save any necessary research documents that have been produced in an organised manner, so that they can be retrieved easily and efficiently in the future. Having the ability to assign new and pre-existing research also helps firms maintain a compliant audit trail.

Adam Says

“With all the features covered above, plus so many more, I believe FE Analytics is an extremely useful resource for adviser firms to monitor client portfolios and make informed investment decisions. With such an in-depth information resource available, I believe this is a go-to tool for anyone looking to perform fund/investment analysis and research.”

Our Thoughts

Good Features:

- Users do not need to install any software. The tool is web-based and can be accessed from any location through various devices.

- The tool allows users to create individual portfolios so that analysis can be performed on a client’s overall holdings.

Great Features:

- Having access to up-to-date factsheets, annual reports, prospectuses and KIIDs in one place, rather than having to search investment managers websites for the literature.

- The ability to set-up various alerts.

- The Investment Forecaster

- The service is integrated with many practice management and other adviser software systems including (TBC).

Improvements:

- The tool can feel quite overwhelming at times and with so much information on offer, having the ability to set-up customisable user profiles depending on specific job roles and needs would be a useful addition.