Views from T3 2020: Morningstar Advisor Workstation 3.0

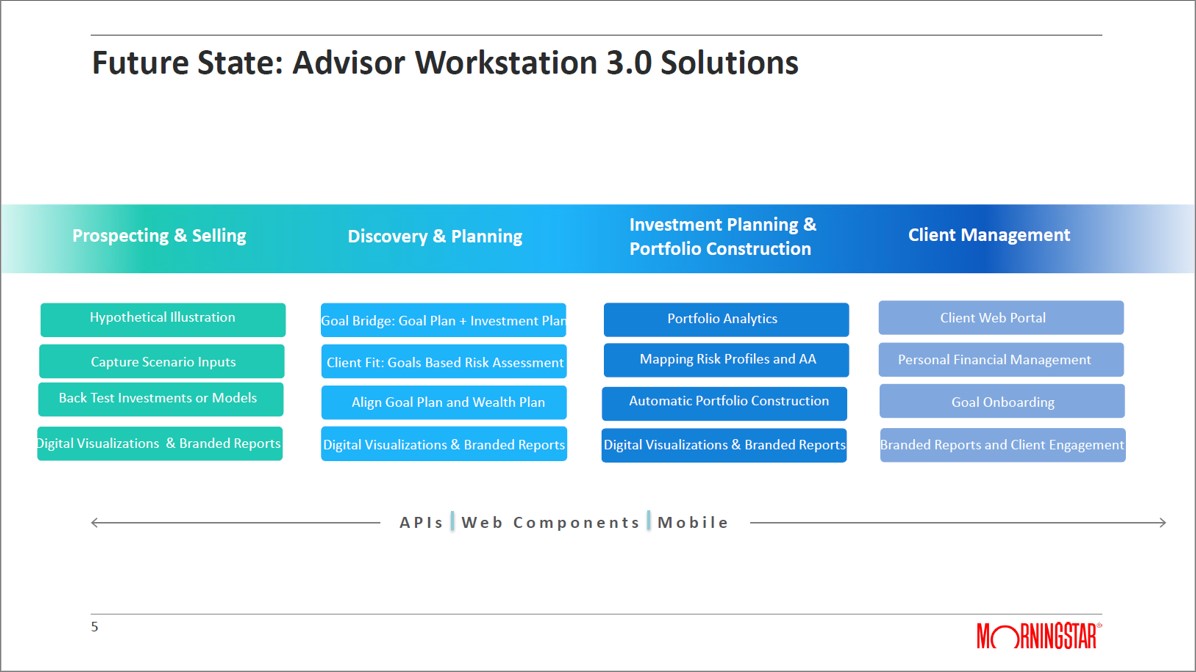

At T3 last week Pete Franco, Morningstar senior product manager for their Advisor Workstation product laid out the roadmap for their 3.0 service. Due for release later this year the product will move on considerably from the previous release and build on the Goal Bridge technology the company demonstrated at the T3 Enterprise conference last October.

Goal Bridge aims to help advisors identify clear goals for clients and uses behavioural finance processes to achieve significant customer buy-in to the goals. This in turn should increase the likelihood that the client will stick with the goals, through good times and bad, to achieve a better outcome. The service also links goals to the portfolio construction process. My full analysis can be read here https://dwi.ftrc.co/views-from-t3-enterprise-conference-2019-morningstar/

The presentation also highlighted what Morningstar intend to be doing in the next 2 to 3 years to meet the needs of their customer base.

The message that really resonated with me during this presentation was the potential offered for digital transformation. While appreciating there are still many consumers who like to receive thick paper documents delivering a vast amount of data on their progress towards that objectives, is this really the optimal way to deliver information in the third decade of the 21st century? Actually, I do question if is it the advisor that is more comfortable with this approach, rather than the consumer? How many clients really read 100+ pages of analysis end to end? Especially when any paper summary can only ever be a snapshot in time and is invariably out of date as soon as it is delivered. In practice do clients really just read the first page and the last?

In the UK I’m frequently horrified to see some technology suppliers build great services, that then necessitate a paper output. We are no longer living in the 20th century, this doesn’t make sense in environmental terms never mind the opportunity to make constantly up to date information the norm.

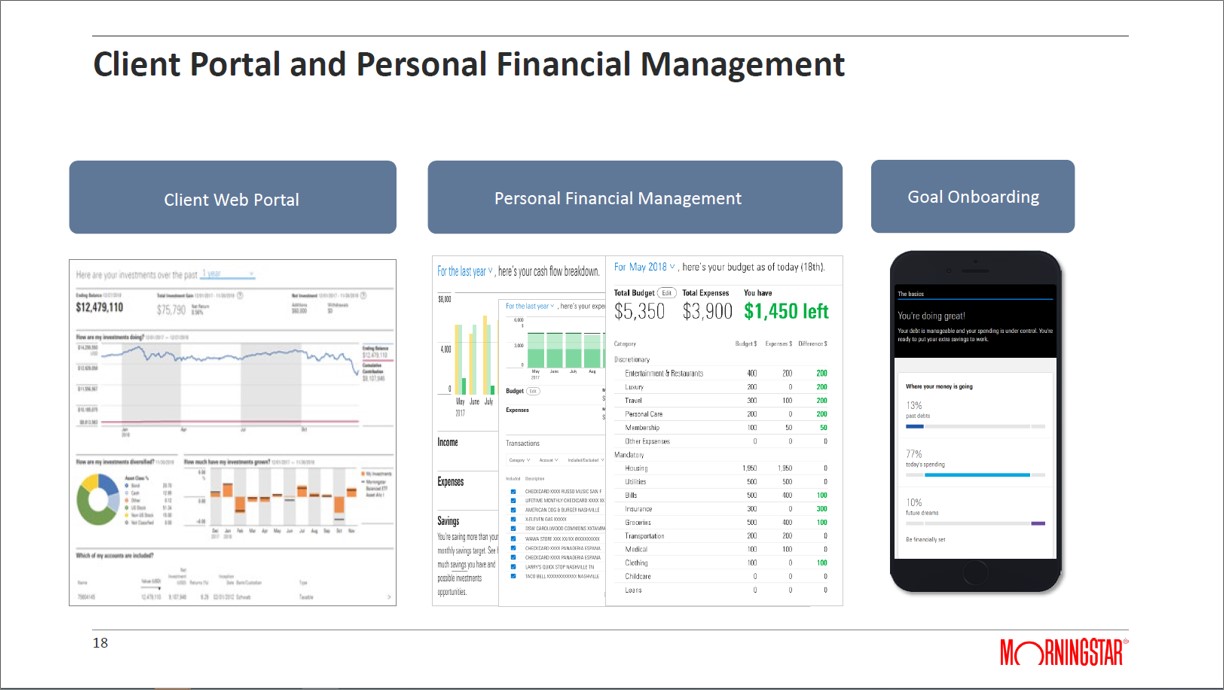

Many UK software suppliers stress how much they listen to their adviser customers. Whilst this is valuable, in my experience the most successful software suppliers also consider, what does the adviser client not yet recognise they will need in the near future? How can they build the services today that adviser firms will need tomorrow, even if those firms don’t recognise it yet? Client portals with Personal Financial Management/Open Banking capabilities are a classic example of this. The UK firms who started building such tools a number of years ago like True Potential, Intelliflo and moneyinfo are now at a significant advantage to their peers.

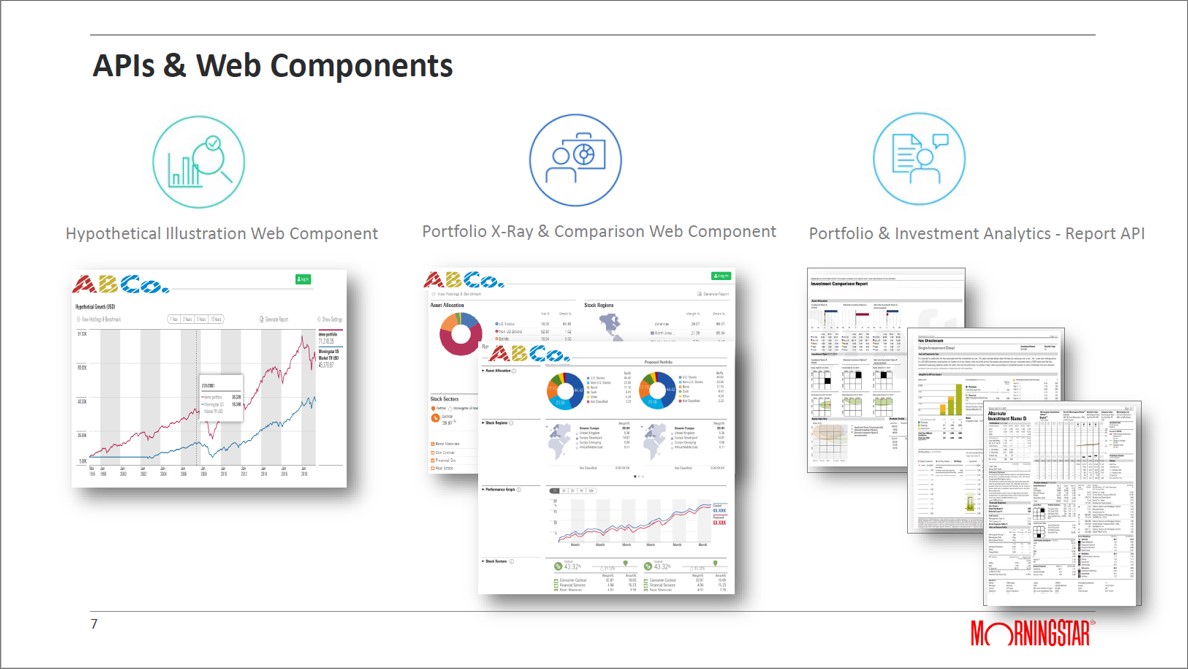

This also raises the question how can advisors take greatest advantage of the range of different software solutions they employ? Franco outlined a vision to create more of a seamless experience behind the scenes and less friction between different systems and technology that advisors are using. This will involve extensive use of APIs and integrations from Advisor Workstation to support an advisor’s chosen software ecosystem.

Highlighting the growth of automation in models, Franco stated 74% of US advisor firms now use models, but in many different ways. These include individual advisor created, a house view from a firm’s chief investment officer, or outsourcing models via a third-party turnkey asset management platform or strategist. Morningstar are clearly in a very strong position to support this given their model marketplace launched last year.

Franco recognised that to deliver holistic advice capturing both the assets the advisor is directly responsible for and held-away investments, is essential have a true picture to base financial advice on. He highlighted that the goals-based planning aspect is becoming front and centre to the advice process. Morningstar’s outstanding behavioural science team has produced some exceptional work such as the Mining for Goals analysis see https://www.morningstar.com/lp/mining-for-goals

The current Advisor Workstation 2.0 is used by approximately 185,000 advisors so clearly has a dramatic impact on asset distribution. The launch of Goal Bridge last September was a major extension for the firm bringing together the goal-setting process and the creation of the investment strategy to execute on those goals.

According to Franco Advisor Workstation 3.0 will collect goals agnostic of investment product but allow users to connect it to investment planning, removing the need to use one software component for financial planning software but then jump out to a separate investment planning software, forming a single platform for both tasks. The system will then connect to a client management component including a client portal. Regardless of the advisor’s individual audience, be they middle market clients, mass fluent, or high net worth, the client web portal will allow advisors to connect with Morningstar’s By All Accounts data aggregation system that can deliver insights for the investor and provide a personal financial management tool for them to all see this information.

Personally, I come across very few UK advisers who yet recognise the potential for automated behavioural finance nudges to deliver enormous additional value to their clients. These can provide an ideal platform to demonstrate the true value of advice to all consumers from those with very modest means, who frequently have a very real desire to save for the future but need help in understanding where they can achieve the necessary economies, all the way through to the highest net worth clients. Those who have substantial wealth rarely achieved such a position by being unnecessarily profligate. In a world where consumers are so frequently passing up confidential data without really seeing any genuine benefit for it, such measures are a perfect way to demonstrate real value. This has enormous potential not just in the traditional IRA and IFA market but particularly amongst members of employer-sponsored retirement plans.

This enables savings and budgeting, of course, and on boarding which allows the investor to interact with their goals via a mobile device. I’m particularly impressed to see Morningstar moving away from a process that involves extensive PDF generation to a more digital solution.

Bringing this process together end to end should address many of the pain points in an advised process which only ever creates a snapshot report that is obsolete the day after it is produced. By digitizing information the service will be delivered by API web components and mobile facilitating digital transformation.

The web components can be connected to an advisor’s proprietary internal system or an enterprise CRM system so businesses can leverage their existing Tech Stack. Services such as Morningstar’s Portfolio X Ray comparison capability can be delivered in this way but also digitised so that it becomes part of the advisor’s back end system.

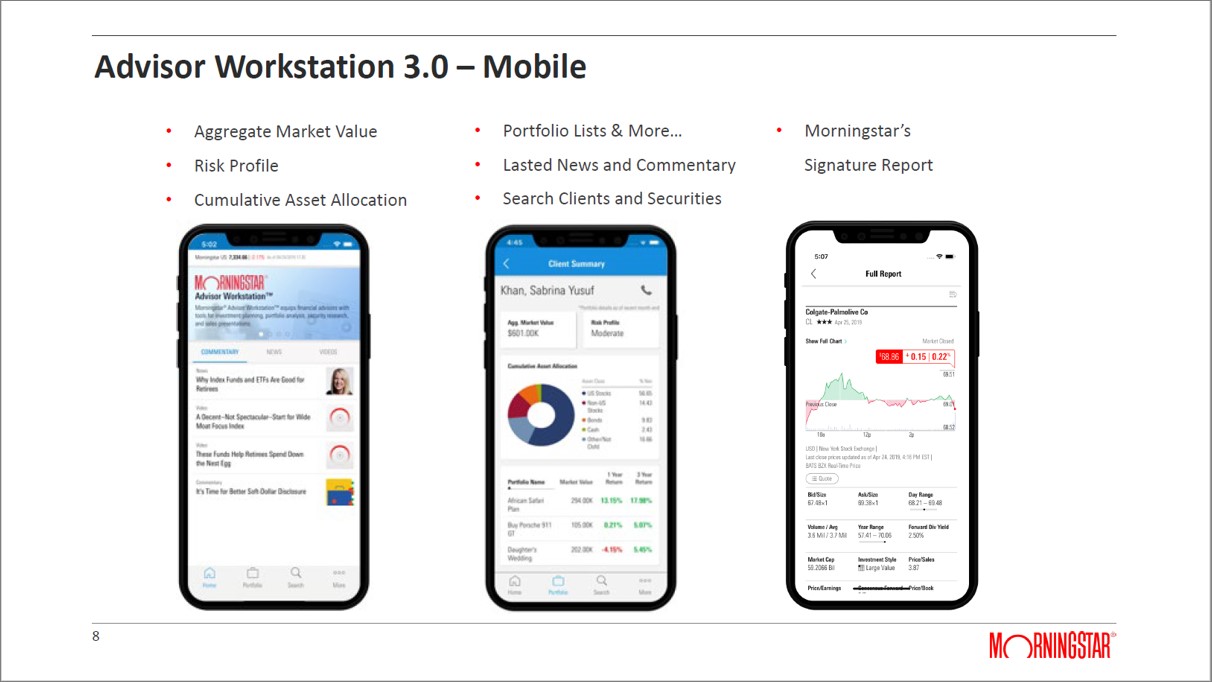

Importantly the detailed investment report is now mobile. There will be a new mobile app for Advisor Workstation 3.0, so the information that has for so long been desktop-based will be at the advisor’s fingertips wherever they are; on a train, on the way to a client meeting or anywhere else it is needed.

An enhanced risk profiling tool will also look at the level of risk needed to achieve a specific goal. This is actually in line with UK regulatory requirements and will make it easier for Morningstar to bring Advisor Workstation to the UK if they want to in the future.

Although the full Workstation 3.0 maybe 12 to 18 months away overall the new service will bring together the best of the capability for which Morningstar has long been well known combined with the aggregation capability from their By All Accounts product. This will include not just investment information, but also banking aggregation, another feature which would help make the product UK ready as Open Banking is fast becoming a must have capability. This will in turn enable really valuable financial wellness recommendations combined with the latest behavioural finance capability their outstanding team have designed, and link this to a process where the consumer and advisor can set goals, create the investment strategy to achieve these and through the digital platform engage with clients whenever they want, providing them with the latest information to ensure that they always have a clear understanding of their progress towards these goals.

The 3.0 Advisor Workstation product will clearly be a major step forward for US advisors and if Morningstar choose to bring it to the UK would have much to offer advice firms on this side of the Atlantic.

Post conference note:

As our analysis was going live Morningstar announced the acquisition of PlanPlus Global and with it FinaMetrica. While PlanPlus has a negligible UK footprint, FinaMetrica has a strong market share and has long been recognised as the more expensive, but higher quality, risk profiling tool of choice for UK wealth managers and advisers.

As one UK AdviserTech CEO put it to me yesterday “FinaMetrica has been the quality tool that the really good guys were prepared to pay for, but lots of advisers opted for something cheaper.”

This makes the case for a dedicated UK version of Morningstar Advisor Workstation 3.0 even more compelling. Imagine bringing together the Goal Bridge technology, with its exceptional behavioural finance base, Morningstar’s outstanding fund analysis and portfolio construction capability, linked to By All Accounts, to aggregate held away assets and ideally open banking, aligned with Finametrica risk tolerance as a platform that can deliver to a client portal, or via APIs, to any third party system, executed correctly, ought to be a truly compelling proposition for top end wealth managers and advisers. I could see this causing a significant shakeup in the UK market and potentially a review realignment of many existing relationships.

If they also added a UK version of the model marketplace launched in the US this might actually be transformational for the British market.