Views from T3 Enterprise Conference 2019: Advicent

When a technology provider can trace its roots right back to the earliest days of financial planning their thoughts on the future deserve to be listened to. Advicent is just such a company.

Last week at the T3 Enterprise Conference their Chief Operating Officer, Anthony Stich, gave not only a fascinating history lesson in how financial planning software has evolved, since December 1969 when Gus Hansch started to develop a system that would become known as Financial Profiles, but also shared his vision for the next ten years. Headlining a “decade of disruption”, he predicted financial planning to become far more accessible to all in society who need it.

Today, Advicent supports the financial planning needs of eight of North America’s top 10 banks, seven of the top eight North American insurers, four of which are the largest across the globe, and over 140,000 active users.

Their technology literally generates millions upon millions of financial plans each and every year with some firms creating more than 500,000 plans annually.

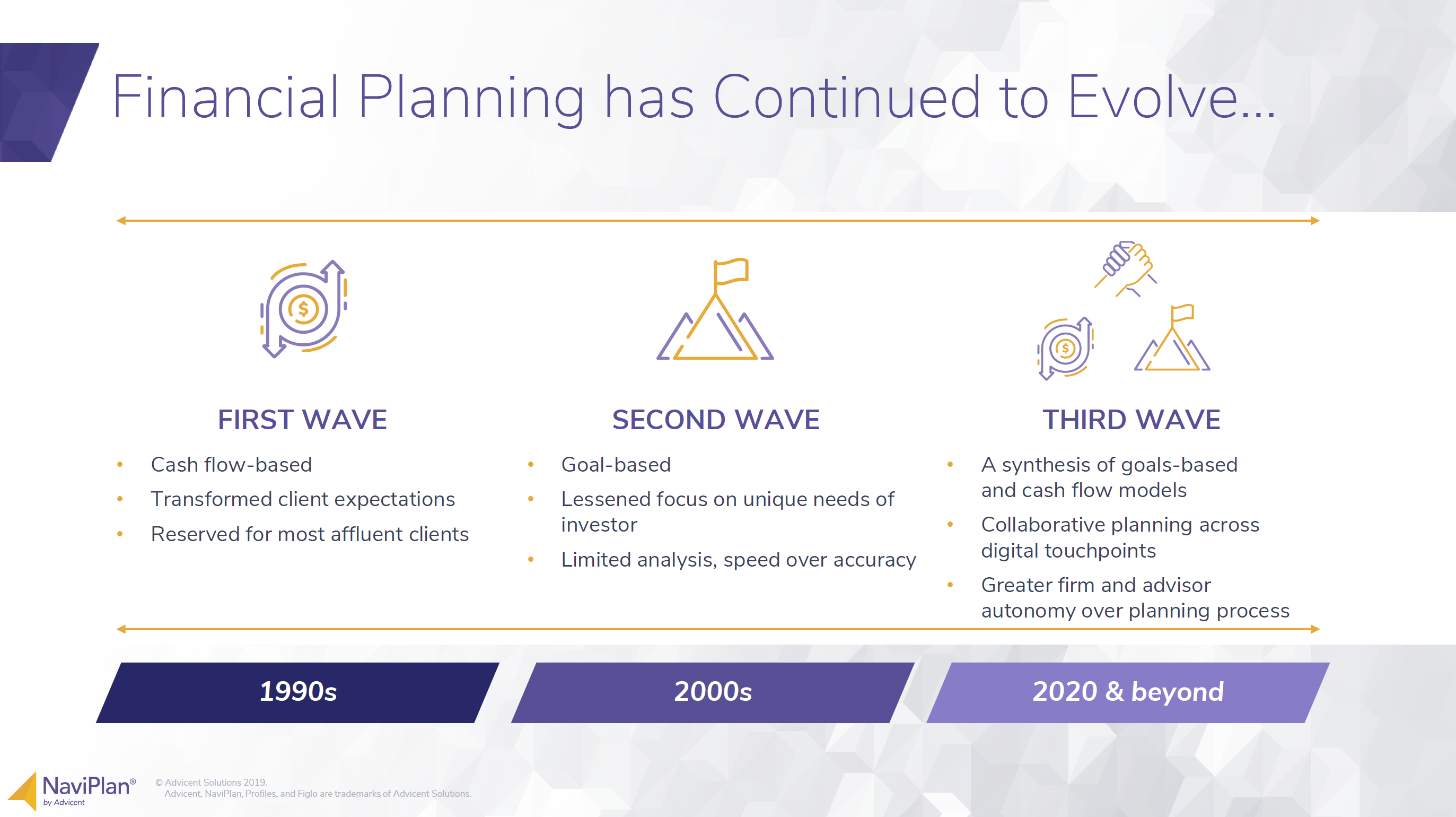

Stich identified that financial planning software has evolved through three major phases and is now entering its third wave, which he believes will enable advisers to support unprecedented numbers of consumers and make financial advice far more accessible and affordable.

The first wave in the last century financial planning software really focused around cash flow planning, building massively intricate documents requiring so much work that they were largely the preserve of very high net worth clients. From a UK perspective this immediately resonated with me thinking about Paul Etheridge and the early days of the Prestwood system. Incredibly complex but no one could deny Etheridge‘s success but as a planner himself and also as someone who schooled large numbers of advisers to follow his unique and lucrative technique.

Early in this century US financial planning software suppliers started moving towards more goals-based solutions with a focus on simplicity. In the UK these moves were mirrored by the likes of Distribution Technology with Dynamic Planner and more recently firms like CashCalc and i4c.

Stich argues that the move to simplicity has however diluted the accuracy of plans and that the new third wave which brings together both cash flow and goal-based planning will provide more sophisticated comprehensive plans.

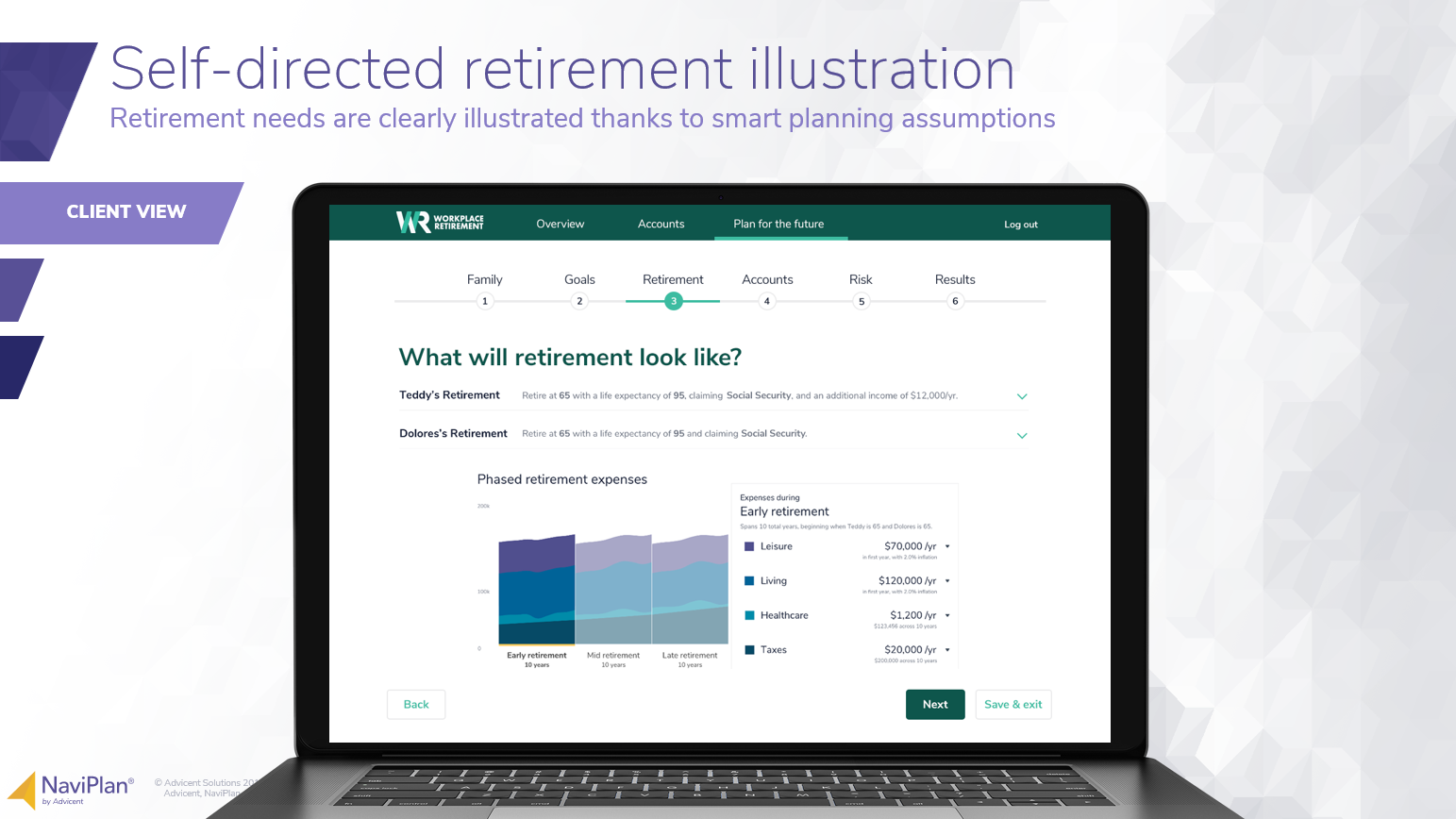

Much of this integrated capability is now possible because the emergence of increasingly sophisticated APIs is bringing far more data seamlessly into the planning process and equally enabling integration with third-party risk engines and assets/investment selection tools. While the presentation was largely strategic, brief demonstrations were given of sophisticated tools that can build detailed financial plans in minutes pulling together income and expenditure data, existing investments, asset allocations, assets and liabilities, and linking these all to a client’s individual appetite for risk. This enables retirement modelling and other financial planning to be constructed quickly and effectively.

Essentially this is technology that can take work that would previously have taken hours and deliver the same granular analysis in minutes.

Interestingly, Tony Stich argues that the biggest impact of Robo-advice to date has been to make traditional advisers think differently and be more prepared to embrace technology. I find this a compelling argument, although, I do see a far more sophisticated set of automated advice tools on the horizon, albeit that they are more likely to be deployed as a hybrid solution letting the technology do the hard number crunching while the adviser provides the soft skills.

While they have a huge presence in North America, Advicent actually operates in eight different countries; Belgium, Canada, Germany, Greece, the Netherlands, Singapore, the United Kingdom, and the United States.

Few advice software businesses have yet become truly multinational. Having already achieved this Advicent are clearly well placed to capitalise on the globalisation of financial advice software which increasingly looks like a major trend for the next five years.