What announcements from Intelliflo mean for Platforms, Asset Managers, DFMs & the rest of the market

What today’s announcements mean from the wider market

Intelliflo’s Change the Game conference today is certainly well named. A whole slew of announcements will have far reaching consequences across the financial advice market.

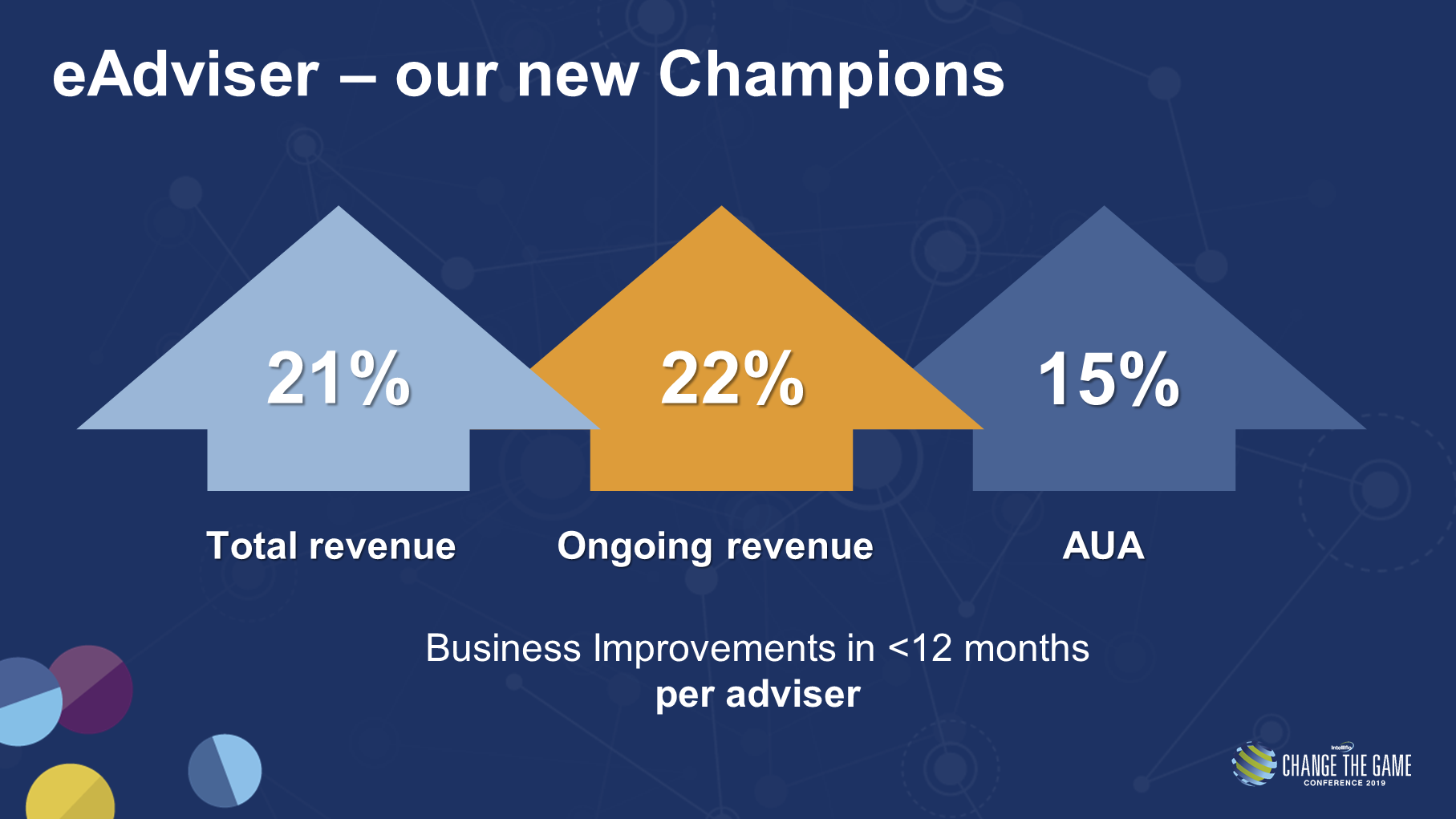

At Change the Game last year Intelliflo announced their eAdviser Index. This measures the success of advice firms in using their software and benchmarked firms underlying assets under advice, profitability and a range of other metrics. It has clearly been a positive stimulus to many users as far more firms have now achieved the higher champions and embracers categories, moving up from being measured as technology explorers or adopters. According to Nick Eatock all the firms who have moved up categories have increased both their turnover and numbers of clients.

Overall, firms in the highest Champions category had 78% higher revenue, 90% more recurring revenue, 92% more clients and 97% more assets under advice than firms in the lowest Explorers group. This data makes a compelling case for advisers generally, and Intelliflo users particularly to make the fullest possible use of the technology they have at their fingertips.

No fewer than 66 firms have moved into the highest Champions category and there has also been progress in the lower tiers. Twenty-eight firms previously in the lowest explorer category have made it to the Adopters level and 114 Firms have moved to the Embracers tier, just below the Champions group. That is 208 adviser firms who have significantly enhanced their adoption and use of technology in under a year with consequent benefits to their firms. These 208 account for about 10% of Intelliflo users so there is a clear opportunity for the other 90%.

If you are an Intelliflo user and your eAdviser index score did not improve this year you really should talk to Intelliflo about why not, and see what can be done to improve your use of their system. You are paying for it, so it makes sense to get the most out of the software. If 208 firms can do better, why can’t you?

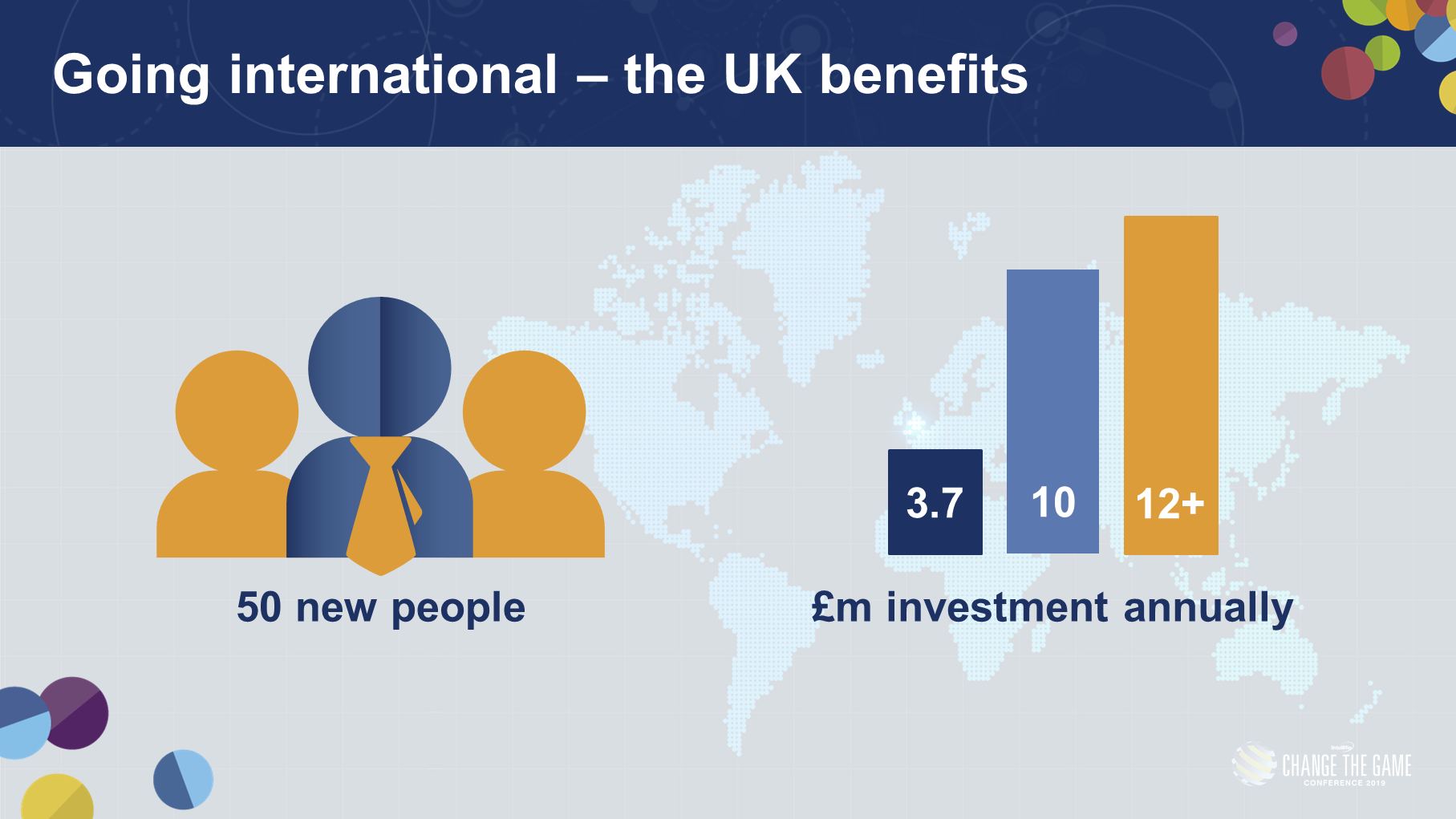

Intelliflo Founder and Chairman Nick Eatock spoke at length today of the consequences of last year’s acquisition of the business by Invesco. This has enabled a three-fold increase in their annual development spend on the UK version of the service. The £3.7 million Intelliflo spent annually before the deal probably exceeded just about any other UK adviser software provider. This budget is now over £10 million year in, year out.

Intelliflo Founder and Chairman Nick Eatock spoke at length today of the consequences of last year’s acquisition of the business by Invesco. This has enabled a three-fold increase in their annual development spend on the UK version of the service. The £3.7 million Intelliflo spent annually before the deal probably exceeded just about any other UK adviser software provider. This budget is now over £10 million year in, year out.

This reinforces to me the importance of any adviser firm gaining a clear understanding of the level of ongoing investment their technology supplier is making in keeping their product up to date. If it is less than a million a year it is probably time to start looking at alternative suppliers.

The worst kept secret at the event was confirmation that a multi-jurisdictional international version of Intelligent Office is to be launched, starting in Australia where the company will employ over 50 new staff over the next 18 months. Talking to Eatock recently he was keen to stress this is not just an Australian version of the product but one which can take the company into different markets around the world. There will continue to be one central version of Intelligent Office, but it will be configured differently depending on the jurisdiction. Importantly this gives the company the opportunity to spread the cost of development across customers globally rather than needing to recoup it all from UK clients. Given the numbers involved this should be seen as positive by UK customers.

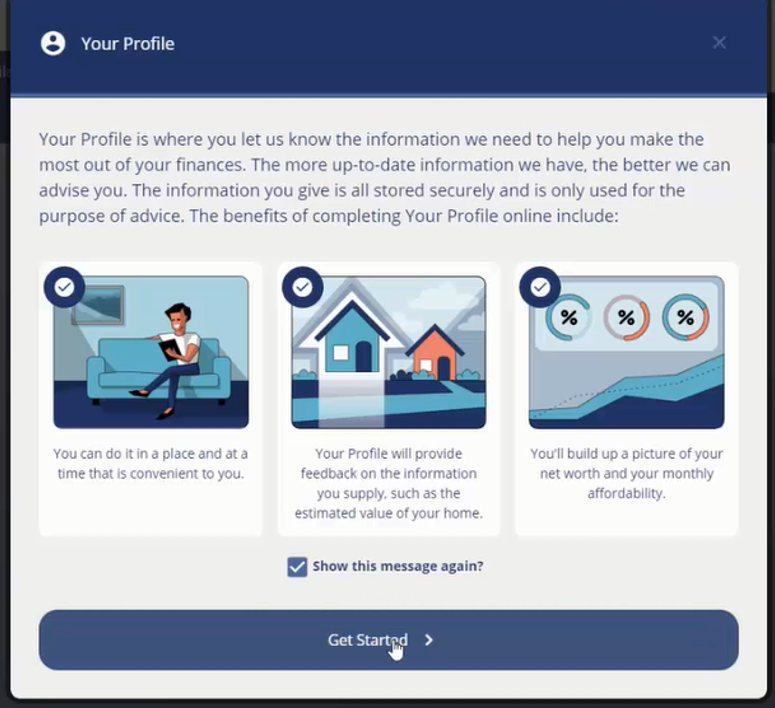

Today sees the launch of the “Gamified” fact find capability. This was announced at last year’s conference and frankly has taken significantly longer to deliver than Intelliflo originally anticipated. It enables advisers to make an online fact find available to clients before an initial or review meeting and is structured in such a way to encourage clients to provide more information by giving them analysis of their personal circumstances in response data supplied. For example, if you add a property to the fact find the system finds a picture of the house, the purchase price history and updates the current market value. Equally when a client in employment adds their income details, the system will carry out tax calculations and play back the net income figures to the client. Such features are designed to drive customer engagement and ownership of the fact find as something they created. Recent research by Morningstar has demonstrated that when a client takes ownership of their financial plan, they are far more likely to see it through.

Today sees the launch of the “Gamified” fact find capability. This was announced at last year’s conference and frankly has taken significantly longer to deliver than Intelliflo originally anticipated. It enables advisers to make an online fact find available to clients before an initial or review meeting and is structured in such a way to encourage clients to provide more information by giving them analysis of their personal circumstances in response data supplied. For example, if you add a property to the fact find the system finds a picture of the house, the purchase price history and updates the current market value. Equally when a client in employment adds their income details, the system will carry out tax calculations and play back the net income figures to the client. Such features are designed to drive customer engagement and ownership of the fact find as something they created. Recent research by Morningstar has demonstrated that when a client takes ownership of their financial plan, they are far more likely to see it through.

A further key announcement today is that Intelliflo will launch an Open Banking service which will be free of charge for their adviser clients. This is very significant, it means that not only can advisers start substantially reducing the cost of assembling and maintaining the underlying data necessary to give advice but they will also be able to obtain, with client consent, far more accurate and granular data about an individual’s income and expenditure.

This will enable more accurate cash flow forecasting and retirement planning and, if linked to agreement in principle services, it could transform the mortgage application process so that affordability checks could be carried out dynamically in real time before applications are submitted. To be fair, Intelliflo have yet to announce any such automation but there are a number of other organisations who have already built this capability, none however has over a third of the IFA market using their system as their core practice management tool. It may be, to achieve speed to market Intelliflo will partner with organisations like Experian subsidiary HD Decisions and Castlight Financial who have already built such capability.

Using Open Banking data to streamline mortgage applications could also open the door for drastically reducing the time to get life assurance contracts put in force if Intelliflo chose to create a similar arrangement to the one Royal London created for London & Country two years ago which I explained in more detail here: https://www.moneymarketing.co.uk/issues/6-july-2017/ian-mckenna-royal-londons-protection-mortgage-advice-game-changer/

While the Open Banking service will be free where data has to be obtained via other methods, because the relevant bank or financial institution does not yet have or, as in the case of investment platforms like Hargreaves Lansdown, is not yet required to offer open data, the old style screen scraping service will continue be used. This will continue to be powered by Yodlee and is currently priced at £1 per client per month.

While the Open Banking service will be free where data has to be obtained via other methods, because the relevant bank or financial institution does not yet have or, as in the case of investment platforms like Hargreaves Lansdown, is not yet required to offer open data, the old style screen scraping service will continue be used. This will continue to be powered by Yodlee and is currently priced at £1 per client per month.

In announcing the service Eatock cited recent analysis from Yodlee owner Envestnet. Their CEO Jud Bergman pointed out that their experience, in the US, is that advisers using third party data aggregation, which is what Open Banking and screen scraping are, typically advise on 80% of their client’s wealth as opposed to 35% where advisers don’t use such capabilities.

When referencing this Eatock positioned the new service as an opportunity for advisers to grow their businesses by 250% with no extra monthly outlay. Up to now relatively few UK advice firms have bought into the benefits of aggregation. These numbers must make a strong case for looking again at what is involved?

To offer Open Banking Intelliflo have to become regulated by the FCA as Account Information Service Providers. I am told this regulatory permission has been applied for and is being processed. The new service cannot start until this is granted, but when it is this will mean Intelliflo adviser clients using the service themselves will not need to apply for AISP permissions in their own right.

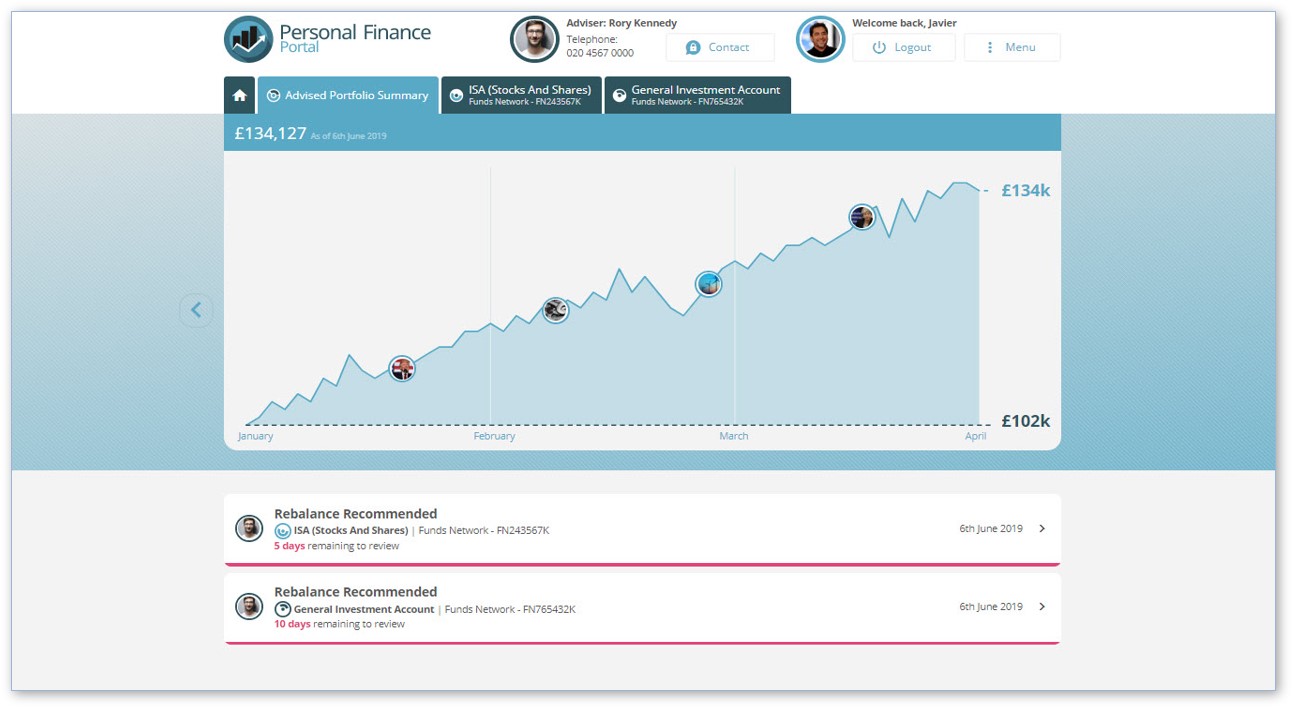

Eatock left the biggest news of the day until the end, the announcement of Intelliflo’s Integrated Model Portfolio Service. Independent research involving 228 adviser firms identified 80 steps in the advice process that were common across all firms. From these there were eleven that advisers found most difficult to address.

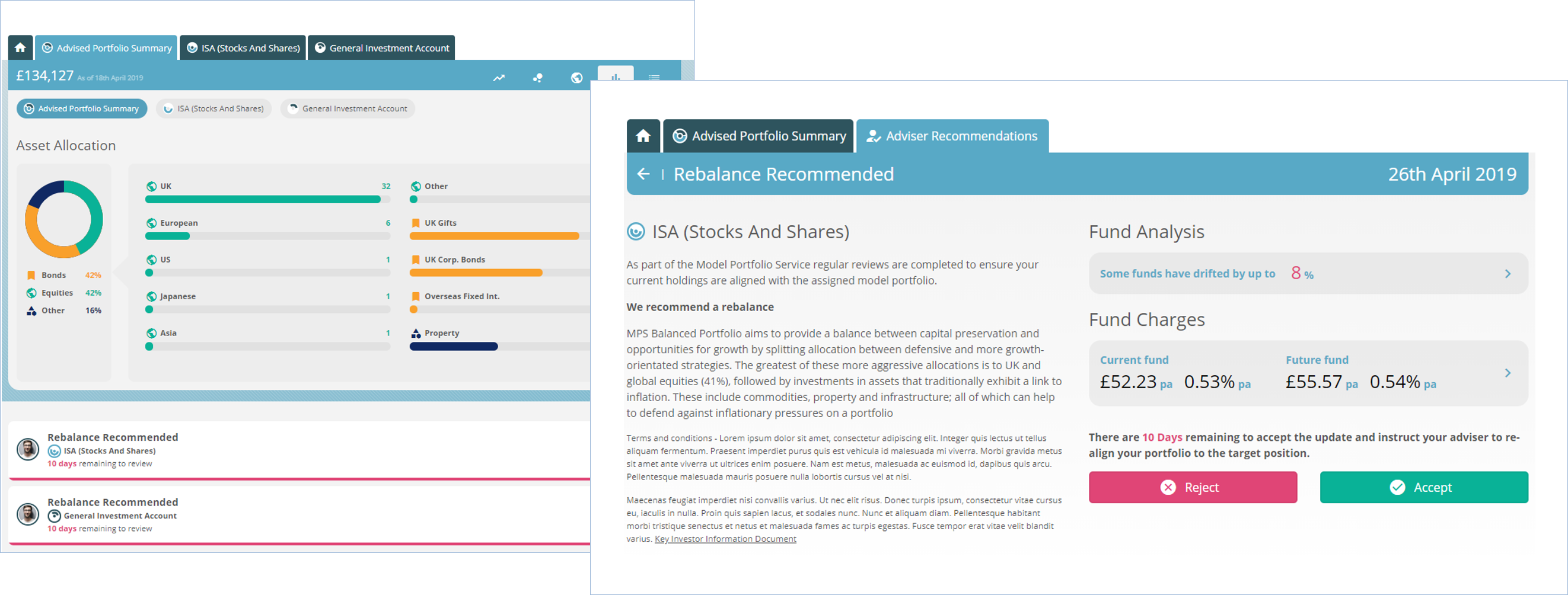

These fell into three key areas: obtaining consent from clients to make the necessary changes to portfolio, minimising losses by ensuring these changes are made in a timely fashion and avoiding portfolio fragmentation that comes from clients not always responding to rebalancing recommendations.

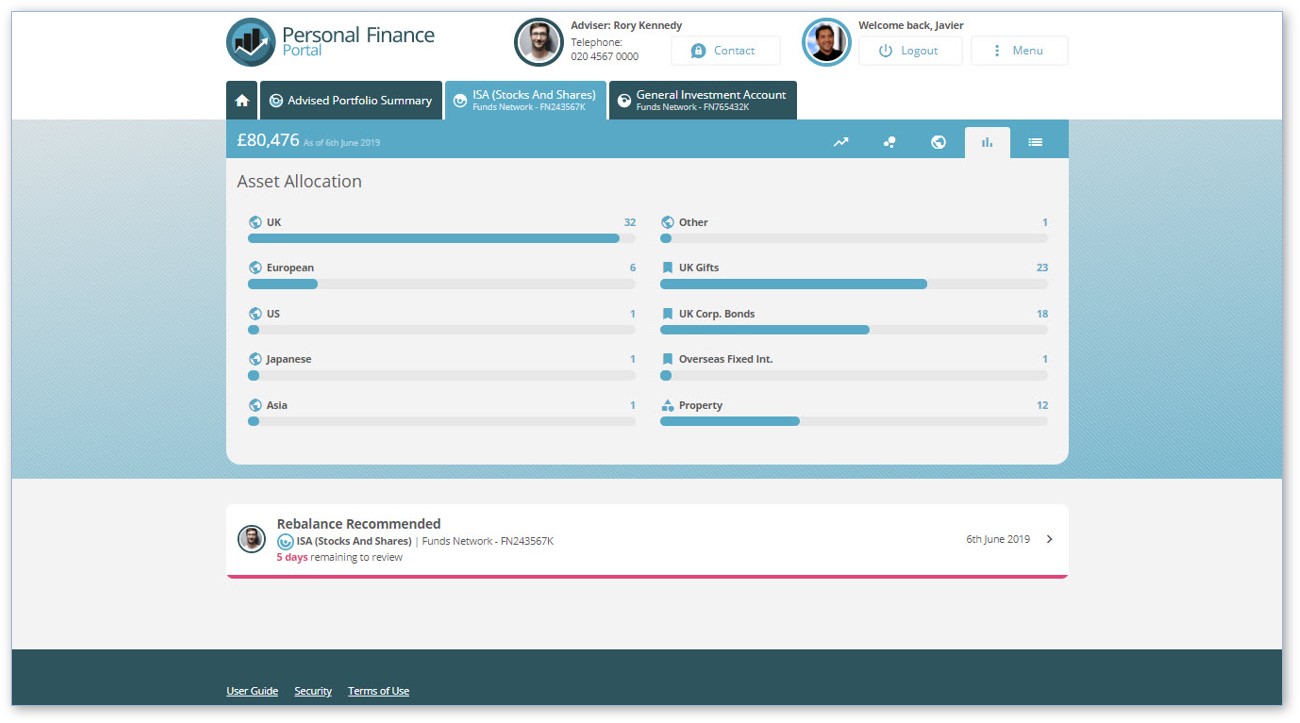

To address these issues the iMPS will allow advisers to select models for their clients from third party providers of model portfolios. The Intelliflo software will then work out if the client’s portfolio needs to be rebalanced to align with the model and if so, will produce all the necessary documentation, cost and charges disclosure, KIIDs etc including analysis to explicitly show where the existing portfolio is out of kilter with the model. This will include all the necessary details of costs and charges disclosure generated both as text and as graphics with easy accept or reject buttons for the client to give electronic instructions.

Where a rebalance is necessary this will actually be carried out on the platform and can be executed using an API between Intelliflo and the platform in minutes. Fidelity will be the initial platform partner although I am aware of several other platforms in advanced stages of discussions to deploy similar functionality. If platforms choose not to build the full integration with Intelliflo there is a CSV based download/upload version of the service which Intelliflo estimate will take around 20 minutes per client to process as opposed to 2 minutes using the integrated version.

Where a rebalance is necessary this will actually be carried out on the platform and can be executed using an API between Intelliflo and the platform in minutes. Fidelity will be the initial platform partner although I am aware of several other platforms in advanced stages of discussions to deploy similar functionality. If platforms choose not to build the full integration with Intelliflo there is a CSV based download/upload version of the service which Intelliflo estimate will take around 20 minutes per client to process as opposed to 2 minutes using the integrated version.

The launch of Intelliflo’s Integrated Model Portfolio Service will also have a dramatic effect on the future of the platform market. Intelliflo are continuing to take an open architecture approach to integration and are happy to allow any platform to deploy the streamlined process. I frequently hear advisers say that the perfect investment platform would be one that is invisible, where they can work seamlessly, without the need to leave their practice management system. The Integrated Model Portfolio Service now makes this possible.

I would envisage at least some platforms will fail to take advantage of this, driven by their own egos and insecurities rather than what helps advisers and their clients. This will be a strategic mistake which they may rue in the future. Those tempted not to integrate need to think about what is in the best interests of advisers and their clients. Short term protectionism will hurt in the long run. Any Intelliflo adviser conducting a platform due diligence review should rank making full use of integration, with the consequent time saving, reduced risk or errors and overall business efficiency as a key criterion to benchmark. As part of this service market and model commentary is also provided using the adviser’s branding.

In an overall industry context the biggest news must be the pricing for the Invesco manufactured model portfolios, £1 + VAT per client per month subject to a maximum of £70 + VAT per firm per month, is a level that will doubtless have many discretionary fund firms slaving over spreadsheets to revaluate their commercial models, there are many more announcements that will have broad significance.

I understand the primary target audience for the model portfolios is advisers who adopt an advisory approach to investment, rather than using discretionary fund managers. Research by Invesco of 1,045 advisers earlier this year identified that 56% work on an advisory basis. That said, this pricing asks some very real questions about how anything like current levels of DFM charges can be justified?

I understand the primary target audience for the model portfolios is advisers who adopt an advisory approach to investment, rather than using discretionary fund managers. Research by Invesco of 1,045 advisers earlier this year identified that 56% work on an advisory basis. That said, this pricing asks some very real questions about how anything like current levels of DFM charges can be justified?

At this level I would imagine most advisers will not seek to pass it on to individual clients. If the vast majority of the inefficiencies in advisory models is taken out through the use of technology, via system integration between the adviser software and the platform, how much downward pressure does this put on the price of discretionary services going forward? Can as much as 85bps or more, on top of the actual investment management charge really be justified?

Even if the adviser does pass the cost on my quick calculations suggest the Invesco portfolios will be cheaper for clients investing more than £2,400 if a DFM charges 0.5%, or £1,412 if the DFM is priced at 0.85%. Let’s put this into context, such pricing is great news for clients of Intelliflo adviser customers and the advisers themselves.

The timing is also hugely significant, coming just a couple of weeks before the closing date for the FCA’s call for input on the review of RDR. Based on this evidence I believe there is a strong case for the FCA to allow changes driven by enhanced technology for at least a year if not two, in order to allow the full effects of these changes to find their way through the market.

It is important to remember Intelliflo is currently the practice management system of choice for 35% of advisers in the market so a lot of firms just got offered solutions that could significantly reduce the overall cost of advice. It is inconceivable that other software suppliers, platforms, DFMs and asset managers will not respond, but it will probably take them a good six months to work things through. That said the landscape could start to look very different 12 months from now. The impact of RDR and technology may have taken longer to work through than expected but both these recent developments are examples of price compression that could bring real benefits to consumers.

It is important to remember Intelliflo is currently the practice management system of choice for 35% of advisers in the market so a lot of firms just got offered solutions that could significantly reduce the overall cost of advice. It is inconceivable that other software suppliers, platforms, DFMs and asset managers will not respond, but it will probably take them a good six months to work things through. That said the landscape could start to look very different 12 months from now. The impact of RDR and technology may have taken longer to work through than expected but both these recent developments are examples of price compression that could bring real benefits to consumers.

The various announcements made by Intelliflo today considerably raise the bar in what advisers can expect of their practice management system. Inevitably their key competitors such as Iress, Focus, Plum, Time4Advice, Creative Technology and True Potential will all need to react. It is important that these firms and others keep Intelliflo on their toes. A single dominant practice management system would not be healthy for the market, but there is a serious question to be asked. The FCA say there are around 32,000 advisers in the market. If there is an adviser to support staff ratio of say 1.5 that adds another 48,000 possible licences. How many practice management systems can an 80,000 licence UK market support?

I see all the above-named firms, for a whole range of reasons as being able to provide viable solutions in the UK market long term, outside that list I would want to see some very strong evidence to demonstrate a long-term future.

Transparency disclosure Intelliflo are a long-standing client of FTRC and we have considerable input into their strategy and plans. This analysis has not been commissioned by Intelliflo and is the author’s independent assessment of the announcements made today, influenced by our understand of Intelliflo strategy and experience working with them.