7IM’s new and improved website

In its ongoing commitment to deliver an unrivalled experience 7IM recently decided to review and completely refresh their websites, to ensure they are easier to navigate and digest for advisers and clients alike.

The new site 7IM.co.uk includes a main corporate area where advisers, clients or even future colleagues can find general information about 7IM, their funds, press releases and even careers for those looking to join 7IM. 7IM previously had two dedicated user sites: private client and intermediary. However, in addition to the new corporate site, there are now 3 other new core sites which can either be visited directly from the corporate site or accessed directly: 7IM for financial advisers, 7IM for clients of financial advisers and 7IM for private clients.

Each type of user can use the log in button at the top of the screen to reach the wealth management platform or client portal quickly and easily. Importantly the sites are fully mobile responsive so advisers can view all the information from the fund centre, platform or even literature on the go.

We really like the way the dedicated area for adviser’s clients supports the adviser’s role offering them guidance on general topics. For example, how to log onto the client portal, or download the 7IMagine app.

The refreshed financial adviser site also has a clean, slick feel which should enable advisers to find what they are looking for quickly and easily. It has direct links to 7IM’s different services (Platform, Discretionary, Retirement Income Service, and Funds and Models).

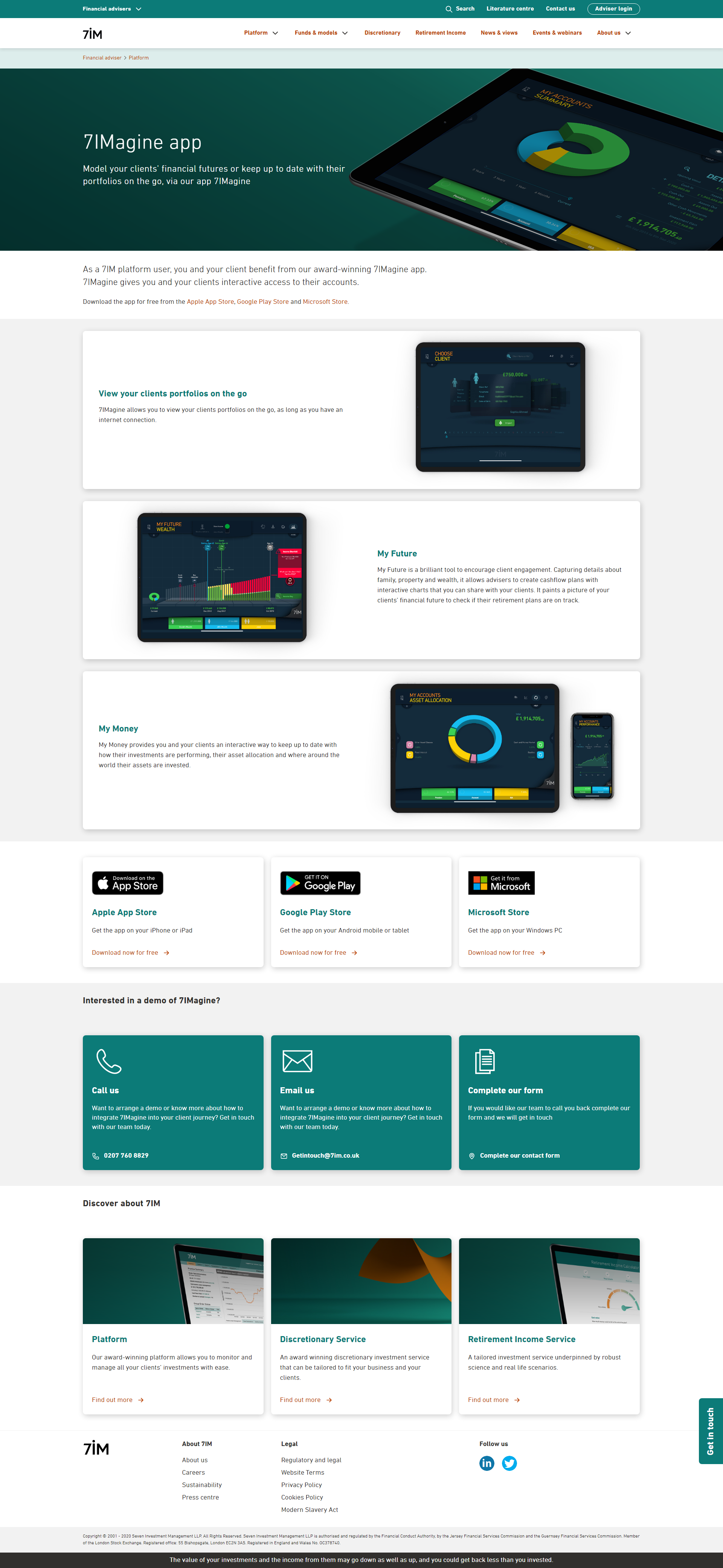

The platform section is now split into two areas: one for existing users and one for new users. A discover platform page has a running total of assets under management, total clients, and total advisers for all users. This provides great transparency about the size and popularity of the firm. It offers prospective clients the ability to gain an understanding about 7IM’s platform without the need to read lots of jargon and text. In this area visitors can also find out more about the 7IM SIPP and the 7IMagine app (available on iOS, Android, and Microsoft).

Using the 7IMagine app (which is free for all Platform clients), advisers can run through a My Future plan that captures details about their client’s family, property, and wealth and produces a cashflow plan with interactive charts. This can then be shared with the client. Within My Future 7IM have enhanced the way income requirements in retirement can be entered. Previously, users could only set a flat rate throughout retirement however, in the new version they will be able to set four different levels. Users can also increase or decrease the income levels in a much easier way, by sliding interactive bars (within the tool) rather than manually entering a figure each time.

When speaking to younger clients about income in retirement it may be hard for them to understand exactly the amounts they require. 7IM have tried to combat this by giving the adviser the ability to select whether income is represented in future terms or today’s terms when setting the retirement income, looking at retirement options, or even on the final cashflow graph.

As well as My Future the app has My Money, which allows users to keep up to date with their investments. For example, valuations, performance, asset allocation and geographical spread.

7IM have also created a dedicated area for their funds and models. This offers details on the various model ranges and gives access to HTML factsheets and fund data. All fund data and documentation are provided by FE Fundinfo, as content has been fully embedded in the 7IM site. As well as funds and models, there is a dedicated area for 7IM’s discretionary investment service. Again, this follows the same slick and easy to follow format.

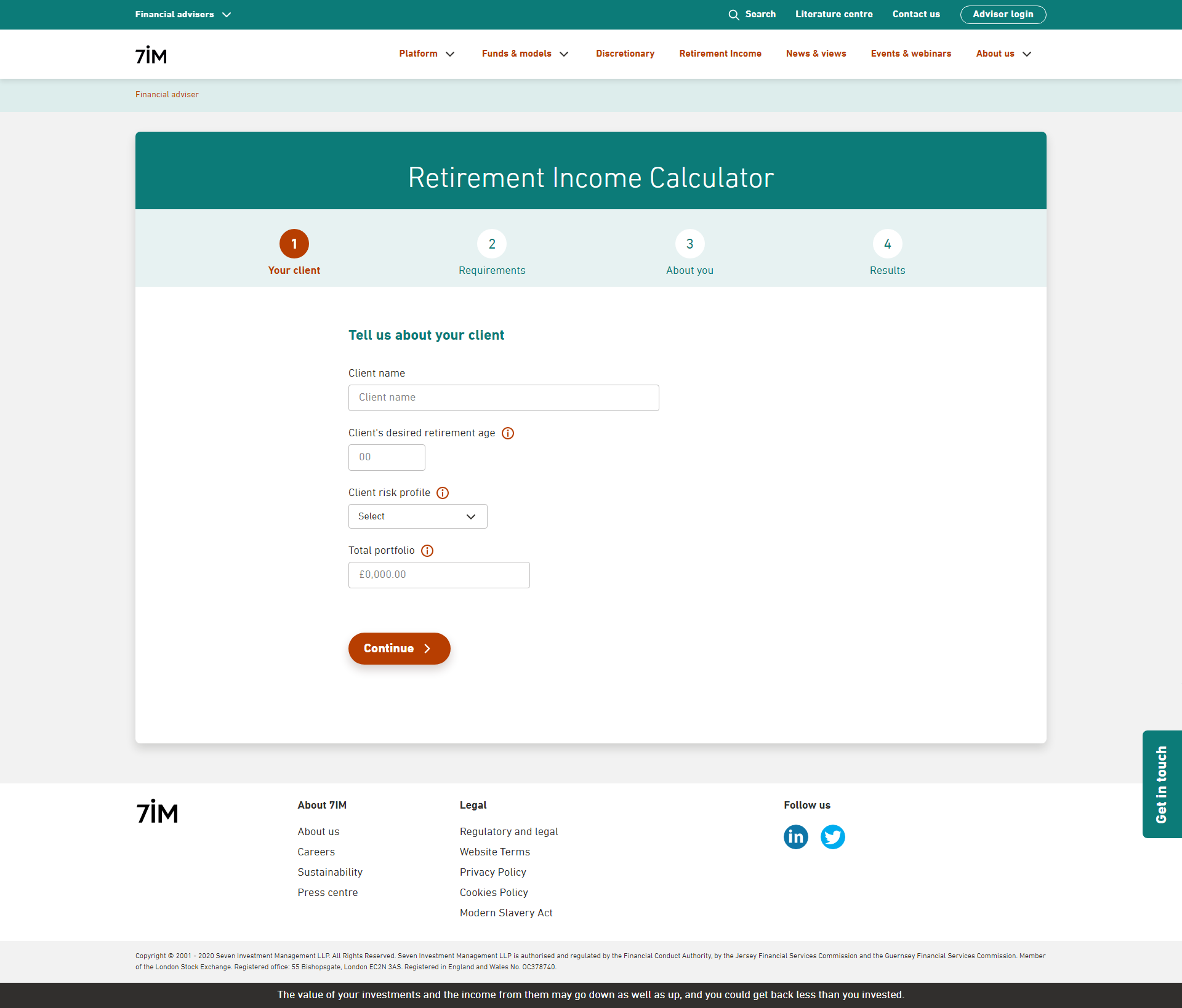

The revamped retirement income area now has a lot more content, to help advisers understand how the 7IM’s retirement service works, the process, and the science behind it. This also houses 7IM’s Retirement Income Calculator, which can be launched directly from the retirement income area.

The Retirement Income Calculator starts by asking basic client details such as name, desired retirement age, their 7IM risk profile and total portfolio value. It then asks three questions about the client’s retirement requirements (gross amount required each year, the length of time it is required for and the amount they would like it to increase by each year). Finally, the adviser inputs some basic details about themselves, including their initial and ongoing fee. The calculator then assesses the sustainability of the client’s assets seeing them through their retirement by showing a probability percentage score (the likeliness money will be left at the end of retirement). In addition, the calculator provides a range of potential outcomes based on the investments and the likely end value of the plan. Based on the risk profile that was entered the calculator also gives details of a proposed portfolio structure. This will show how much will be held in cash, how much is in a short-term, medium-term, and long-term pots, and breaks it down across the different risk profiles. Once outcomes have been produced advisers are able to print a PDF report of the results which can subsequently be sent or shown to existing or prospect clients.

Something I particularly like is the fact that the Income Calculator is available for all advisers, even if they do not use 7IM as a platform and can therefore be a fantastic conversation piece for advisers to take to their clients.

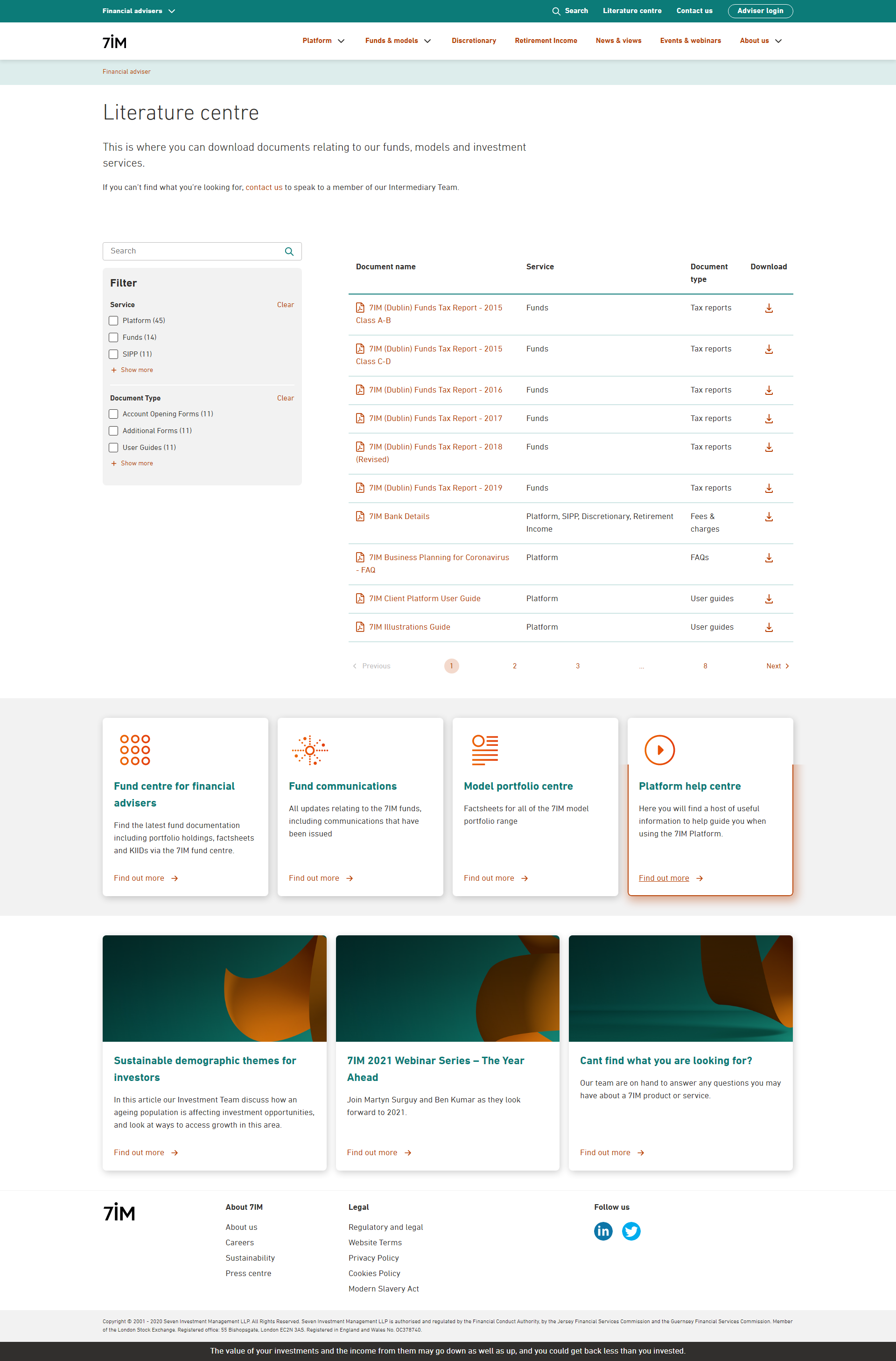

Quick, easy access to literature on the go can be important for advisers and 7IM have clearly made a conscious effort to make their literature area simply to navigate. It is broken down into four areas; the fund centre for financial advisers (that houses fund documentation, factsheets and KIIDs), fund communications, model portfolio centre and platform help centre (which includes video demonstrations on how to use platform functionality).

The previous 7IM sites grew over time so visitors might easily have got lost. The new design feels cleaner, slicker, and much easier to navigate and find information quickly.

Adam Says:

“This complete revamp of the various sites shows 7IM’s continued commitment to helping advisers and private clients alike understand their products, funds, and wider industry issues. This commitment is again highlighted by the fact that they have made their Retirement Income Calculator available to everyone and not just 7IM customers. Another great addition, I feel, is the dedicated site for advisers’ clients. This new user site offers clients guidance on general topics, such a logging onto the client portal or accessing the 7IMagine app, hopefully reducing the number of enquiries advisers might receive around these issues. As well as the enhancements to the various sites, 7IM have also updated the 7IMagine app following feedback they received from the adviser community around income needs in retirement.

Currently 7IM’s Retirement Income Service is only available as part of their discretionary service. Something we would like to see in the future is this service being offered as part of 7IM’s platform (digital online) service as well, so that setting up clients within the Retirement Income Service becomes an even easier process.”